Unlocking Tax Benefits: A Comprehensive Guide to Commercial Property Depreciation

Commercial Property Depreciation: A Comprehensive Guide Introduction: When it comes to investing in commercial real estate, understanding the concept of…

Commercial Property Depreciation: A Comprehensive Guide Introduction: When it comes to investing in commercial real estate, understanding the concept of…

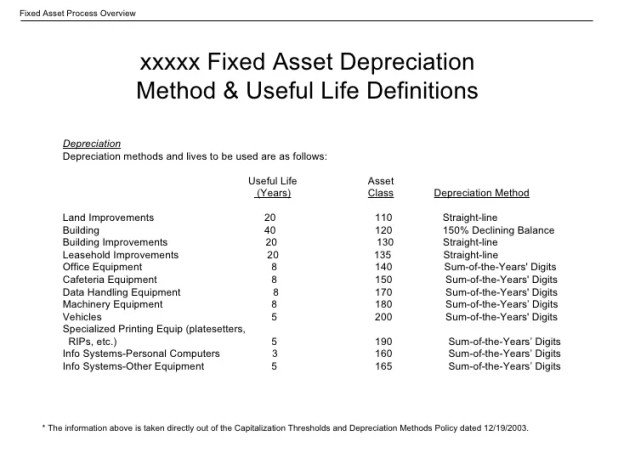

What is useful life and why is it important? Useful life refers to the estimated period of time during which…

Depreciation Expense: Understanding Its Significance in Personal Finance When it comes to managing personal finances, there are several key concepts…

Technology Device Depreciation: Understanding the Value of Your Gadgets When it comes to technology, change is constant. New devices hit…

Furniture and Fixture Depreciation: Understanding the Value of Your Home Investments When it comes to managing personal finances, understanding the…

Depreciation for Leased Assets: Understanding the Key Concepts When it comes to managing your personal finances, understanding the concept of…

Leasing vs. Buying a Car: Weighing the Pros and Cons When it comes to acquiring a new car, one of…

The units of production method is a popular accounting technique used to calculate depreciation expenses for assets that are not…

What is Useful Life of an Asset? The useful life of an asset refers to the estimated duration that an…

Tax depreciation methods are essential for individuals and businesses to accurately account for the wear and tear of assets over…