Unlocking the Secrets of an Asset’s Useful Life

What is Useful Life of an Asset? The useful life of an asset refers to the estimated duration that an…

What is Useful Life of an Asset? The useful life of an asset refers to the estimated duration that an…

Double declining balance method is a widely used depreciation technique in accounting and finance. It allows businesses to allocate the…

The double declining balance method is a widely used depreciation technique in financial accounting. It provides a systematic way to…

Straight-Line Depreciation: A Practical Guide to Managing Asset Value Introduction In the realm of personal finance, understanding depreciation is crucial…

Land improvements are a crucial aspect of property ownership, and understanding their separate depreciation treatment is essential for accurate financial…

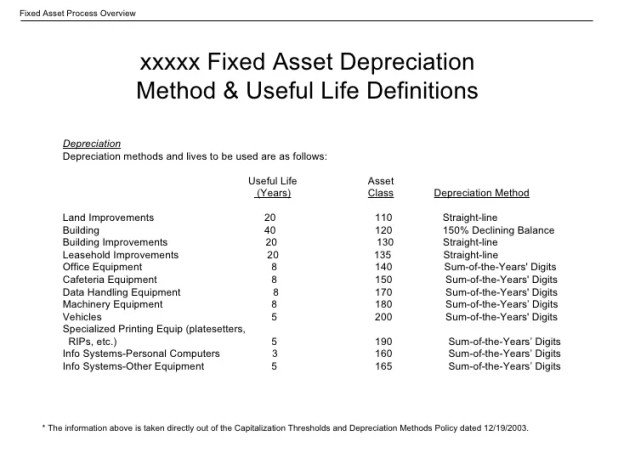

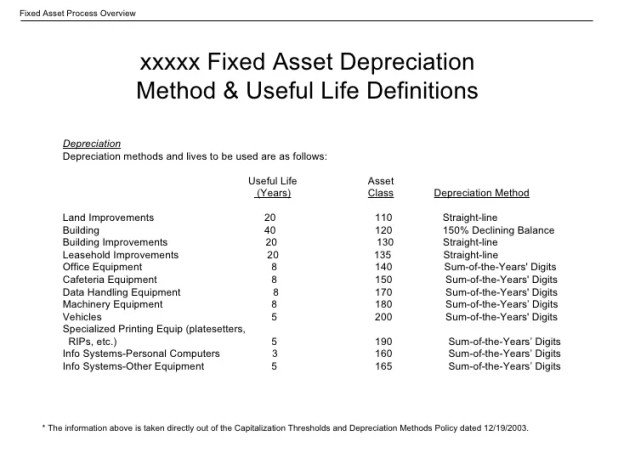

Tax depreciation methods are essential for individuals and businesses to accurately account for the wear and tear of assets over…

Straight-line depreciation is a common method used to allocate the cost of an asset over its useful life. It is…

Group depreciation refers to the process of depreciating assets that are grouped together for accounting purposes. It is a common…

Depreciation Expense on Rental Properties: An Overview Investing in rental properties can be a lucrative venture, providing a passive income…

In the world of personal finance, understanding different methods of depreciation is essential. One commonly used method is the double…