Demystifying Cost Basis: Your Key to Tax Optimization in Real Estate Investments

Understanding Cost Basis for Real Estate Investments Real estate investments can be a lucrative way to build wealth and generate…

Understanding Cost Basis for Real Estate Investments Real estate investments can be a lucrative way to build wealth and generate…

Tax-Efficient Investing: Maximizing Returns and Minimizing Taxes Introduction: Investing is a crucial aspect of personal finance, but it’s not just…

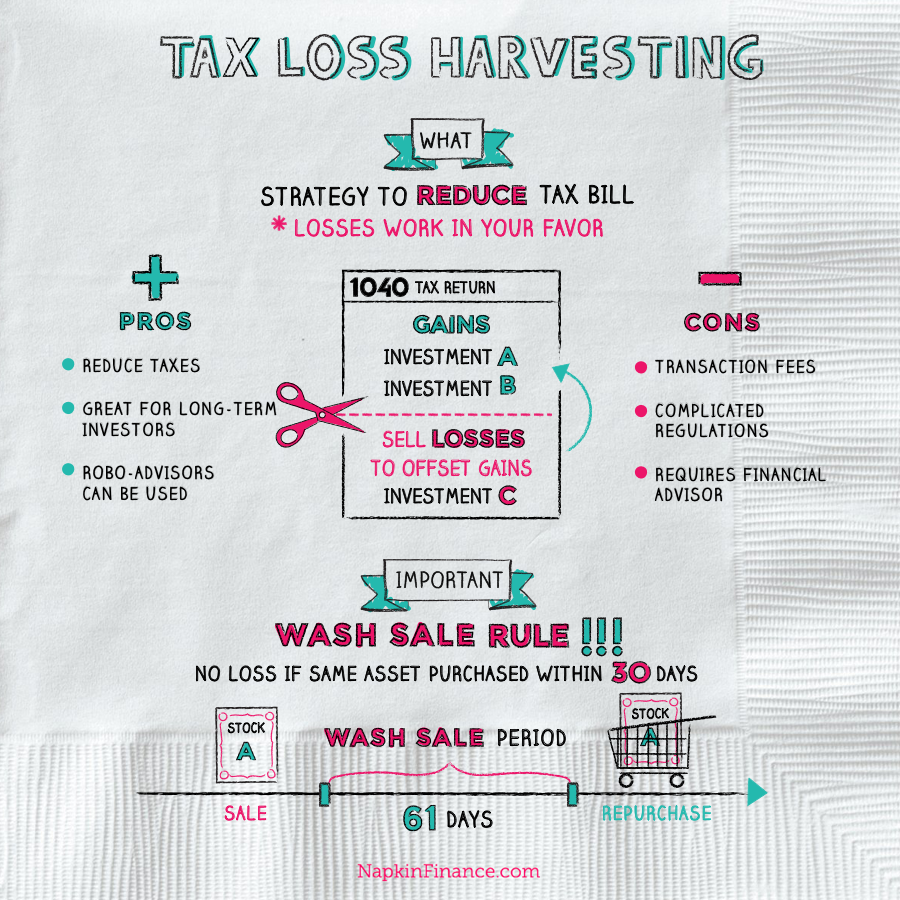

Capital losses can have a significant impact on an individual’s taxes. Understanding how they work and how to take advantage…

Tax season can be a stressful time for many individuals, as they navigate through complex regulations and try to minimize…

Strategies to Offset Capital Gains with Capital Losses Capital gains tax can have a significant impact on your overall investment…

Tax-Loss Harvesting During Rebalancing: Optimizing Your Investment Strategy When it comes to investing, one of the key strategies for maximizing…

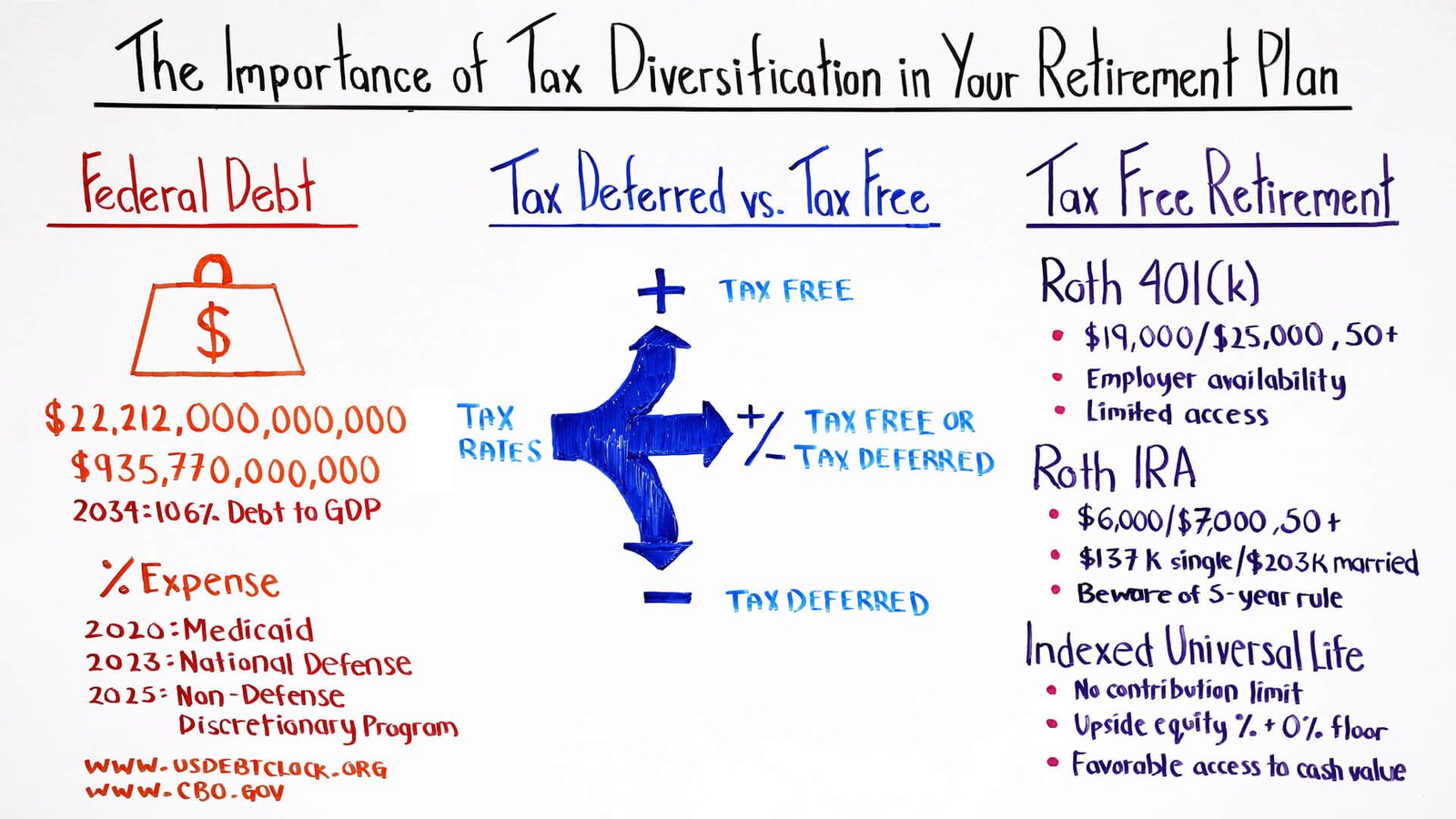

Tax-efficient Diversification Strategies Investing is a great way to grow your wealth over time, but it’s important to do so…

Reporting capital losses on tax returns is an important aspect of managing personal finances. Capital losses occur when the sale…

Tax-efficient investing is a strategy that aims to minimize the impact of taxes on your investment returns. By understanding and…

Capital Gains Tax Rates: Understanding the Basics Introduction: When it comes to investing, understanding taxation is crucial. One important aspect…