Navigating the Tax Maze: Maximizing Dividend Income while Minimizing Taxes

Tax Implications of Dividends Dividends are a way for companies to distribute a portion of their profits to shareholders. These…

Tax Implications of Dividends Dividends are a way for companies to distribute a portion of their profits to shareholders. These…

Tax-Efficient Investing Strategies During a Bull Market Run Introduction: As an investor, finding ways to maximize returns while minimizing tax…

Tax-loss harvesting is a strategy used by investors to minimize their tax liability. By strategically selling investments that have experienced…

Tax-Efficient Investing: Maximizing Your Returns while Minimizing Tax Liability Introduction: When it comes to investing, many individuals focus solely on…

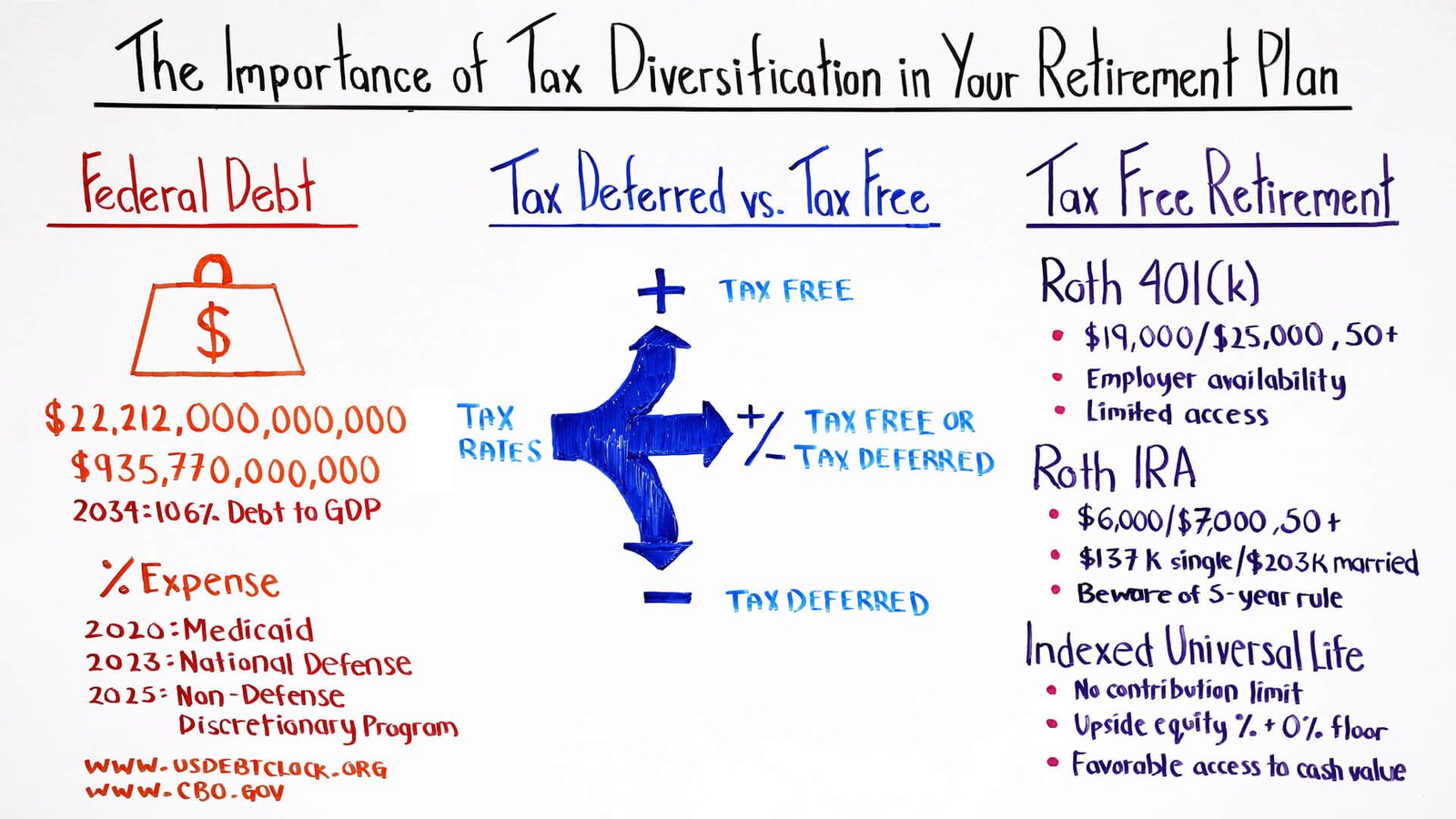

Tax-efficient Diversification Strategies Investing is a great way to grow your wealth over time, but it’s important to do so…

Tax-efficient investing is a strategy that aims to maximize after-tax returns by minimizing the impact of taxes on investment portfolios….

When it comes to investing, maximizing your returns while minimizing your tax liability is crucial. By employing tax-efficient investment strategies,…