Navigating the Tax Maze: Long-Term vs Short-Term Capital Gains Unraveled

Long-term vs Short-term Capital Gains: Understanding the Key Differences When it comes to investing and managing your finances, understanding the…

Long-term vs Short-term Capital Gains: Understanding the Key Differences When it comes to investing and managing your finances, understanding the…

Vesting is a term commonly used in the context of employee benefits, especially when it comes to stock options or…

Inherited Capital Gains: A Comprehensive Guide to Maximizing Your Inheritance When it comes to managing finances, inheritance can be a…

When it comes to personal finance, understanding capital gains is crucial. Whether you are an investor or a homeowner, capital…

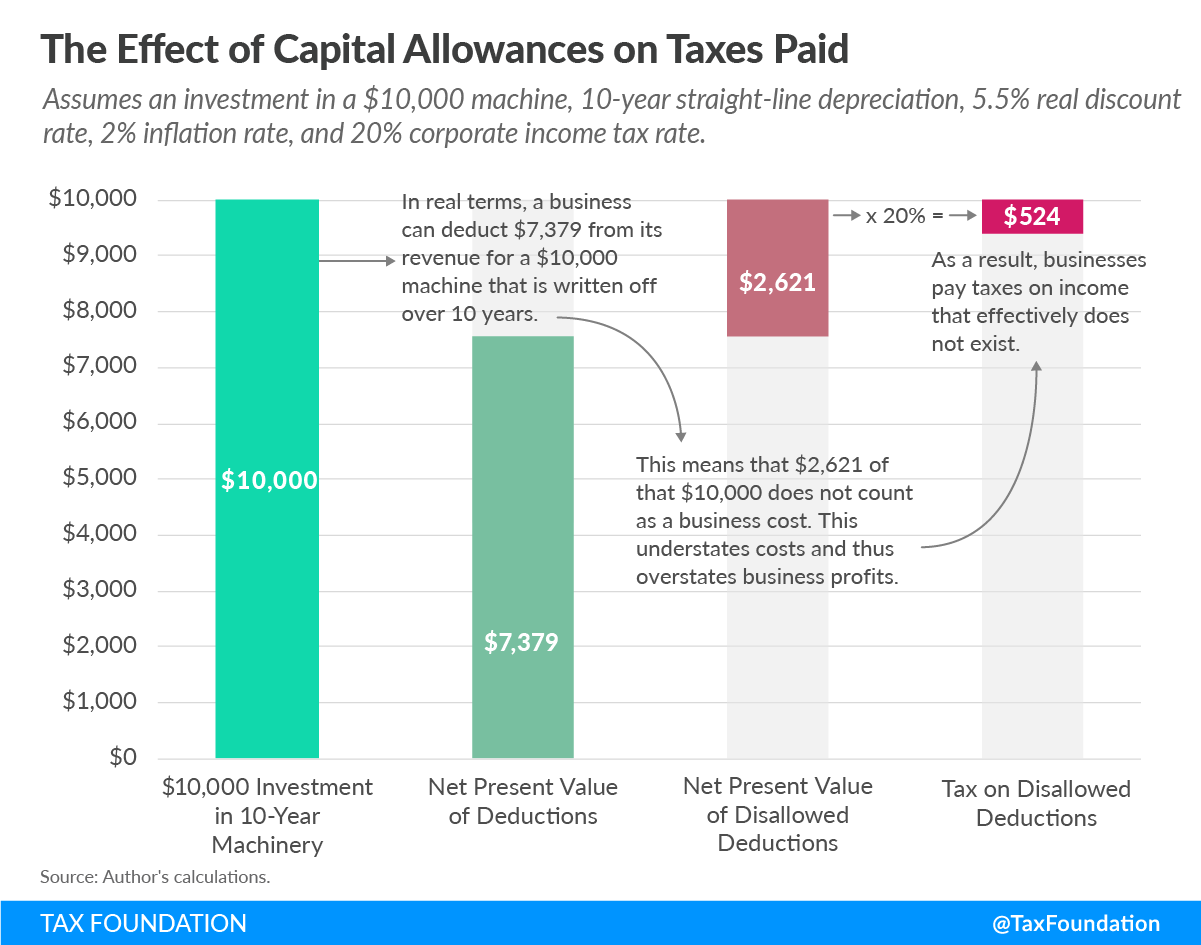

Calculating Capital Gains: A Comprehensive Guide to Understanding and Managing Your Investments Investing in stocks, bonds, real estate, or other…

Capital Gains on Cryptocurrency: A Lucrative Investment with Tax Implications Cryptocurrency has become a hot topic in recent years, capturing…

Foreign Investments and Capital Gains Taxes: A Comprehensive Overview Investing in foreign markets can be an exciting opportunity to diversify…

When it comes to investing, understanding the difference between long-term and short-term capital losses is crucial. Not only can this…

When it comes to investing, one of the key factors that needs to be considered is the time frame for…

Qualified dividends vs. Non-qualified dividends: Understanding the Difference Dividends are a popular way for investors to receive a share of…