Navigating Expat Taxes: FEIE vs. FTC – Which is Right for You?

As an expat, navigating the world of taxes can be a complex and overwhelming task. One important aspect to consider…

As an expat, navigating the world of taxes can be a complex and overwhelming task. One important aspect to consider…

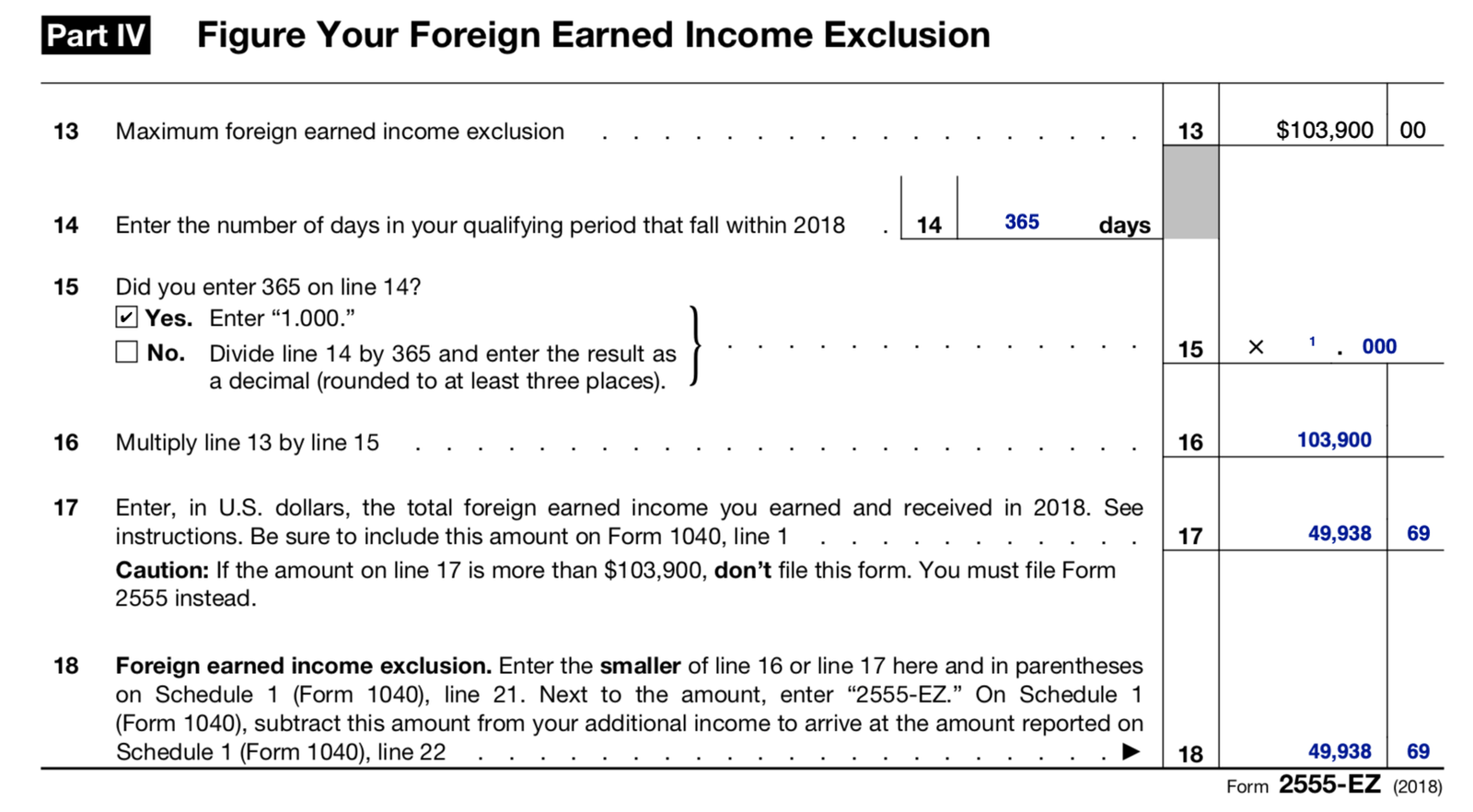

Foreign Earned Income Exclusion: A Guide to Saving on Taxes When it comes to working abroad, there are many benefits…

Tax season can be a stressful time for many individuals, but understanding the various tax implications and deductions can help…

Foreign Tax Credit: A Guide to Paying Taxes on Your Global Adventures Are you a globe-trotter who loves exploring new…

Tax season can be a stressful time for many individuals and families, but understanding the various deductions and credits available…

Taxable income is a crucial aspect of personal finance that individuals must understand to effectively manage their finances and fulfill…

The Foreign Earned Income Exclusion: A Comprehensive Guide to Reducing Your Tax Liability Introduction: Living and working abroad can be…

Taxable income is a concept that can be confusing for many individuals. It refers to the portion of your income…

Taxable Income: Understanding the Different Subtopics When it comes to taxes, there are numerous subtopics that taxpayers should be aware…