“Turning Losses into Tax Savings: Deducting Worthless Securities as Capital Losses”

Deducting Worthless Securities as a Capital Loss Have you ever invested in stocks or other securities that turned out to…

Deducting Worthless Securities as a Capital Loss Have you ever invested in stocks or other securities that turned out to…

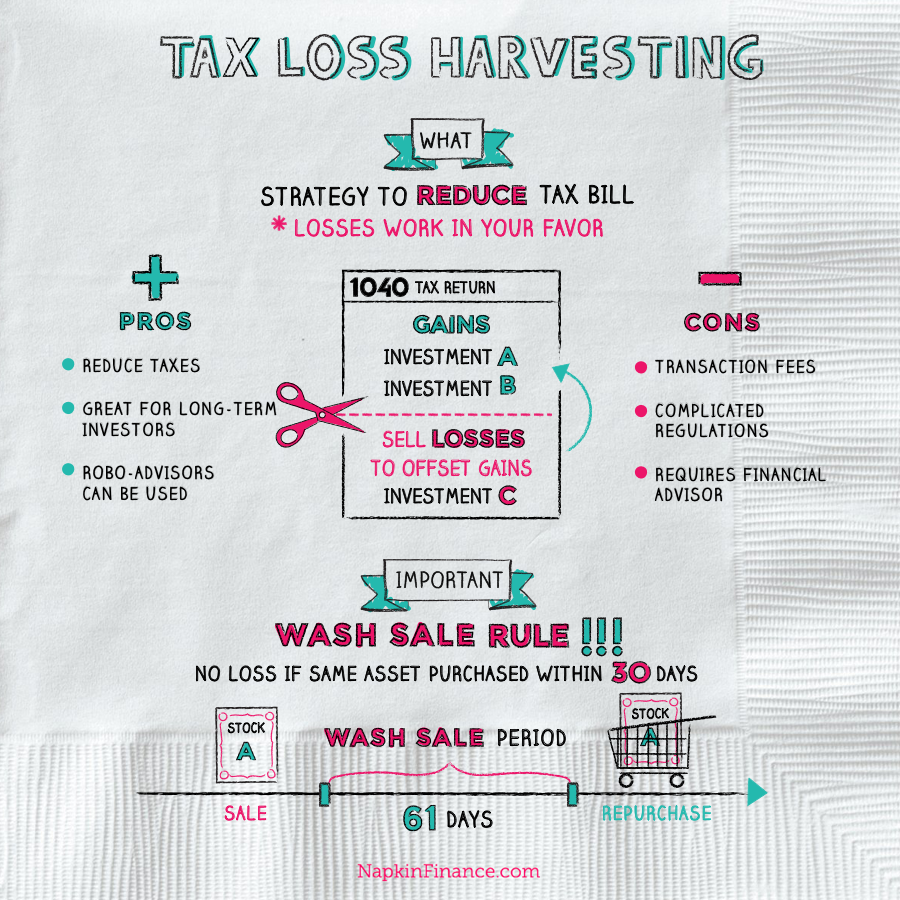

Tax Implications of Capital Losses When it comes to investing, capital losses are an unfortunate but inevitable part of the…

Capital gains are an essential aspect of personal finance that every individual should understand. It refers to the profit made…

Capital losses and their impact on taxes When it comes to investing, there are always risks involved. Sometimes, despite our…

Reporting capital losses on tax returns is an important aspect of managing personal finances. Capital losses occur when the sale…

When it comes to investing, losses are an unfortunate reality. However, there is a silver lining in the form of…

Deducting Capital Losses on Your Tax Return: A Comprehensive Guide Introduction: As tax season approaches, it’s essential to understand the…

Capital gains refer to the profits earned from the sale of a capital asset, such as stocks, real estate, or…

As you approach retirement, it’s important to consider all the possible ways to reduce your taxable income and maximize your…