Maximizing Tax Benefits: Adjusting Cost Basis to Offset Capital Losses

Adjusting Cost Basis to Account for Capital Losses Introduction: When it comes to investing in the stock market, not every…

Adjusting Cost Basis to Account for Capital Losses Introduction: When it comes to investing in the stock market, not every…

In the world of investing, it is crucial to understand the concept of capital gains and losses. When you sell…

Capital Loss Limitations for Partnerships and S Corporations When it comes to investing in partnerships or owning shares in an…

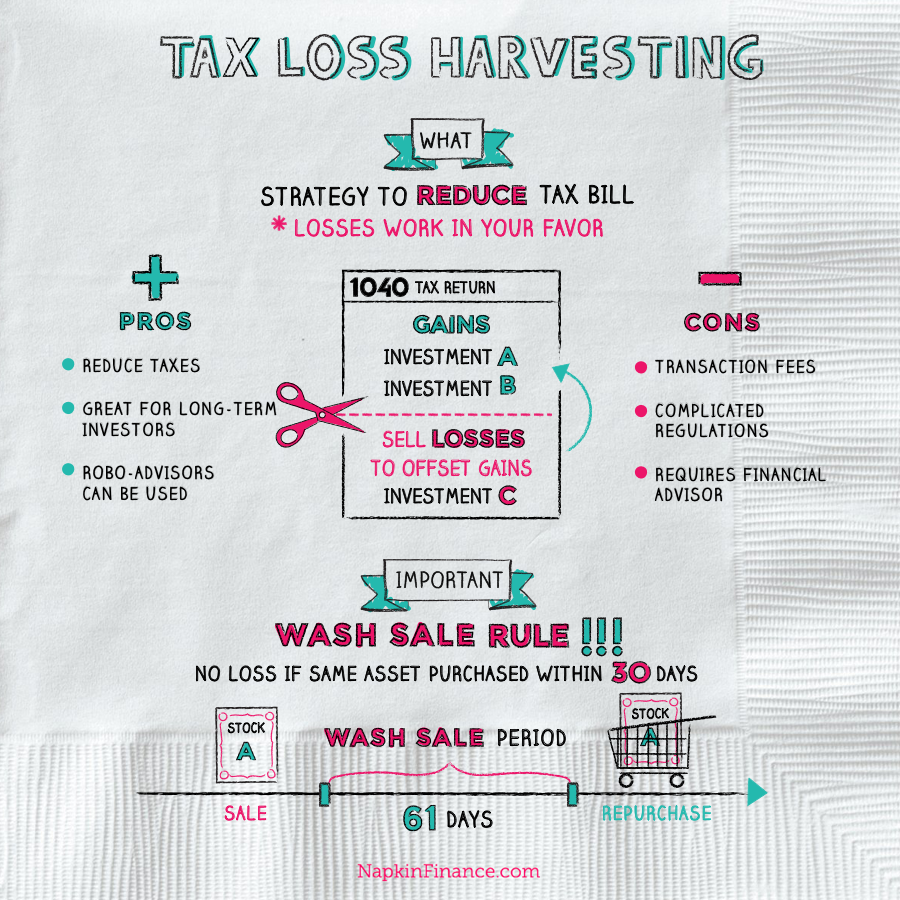

Strategies to Offset Capital Gains with Capital Losses Capital gains tax can have a significant impact on your overall investment…

Case Study: Oprah Winfrey – From Rags to Riches Introduction: Oprah Winfrey, a household name known for her talk show,…

Capital gains tax is a tax imposed on the profit earned from selling certain assets, such as stocks, real estate,…

Real estate is often considered a solid investment, but like any investment, there are risks involved. One of the risks…

Reporting capital losses on tax returns is an important aspect of managing personal finances. Capital losses occur when the sale…

Capital Loss Carryover Rules: Making the Most of Your Investment Losses When it comes to investing, we all hope for…

Strategies for Offsetting Capital Gains with Capital Losses As an investor, it’s important to be aware of the tax implications…