In the world of forex trading, there are various strategies that traders employ to make profitable trades. One such strategy is called breakout trading, which has been popular among forex traders for many years. Breakout trading involves identifying key levels of support and resistance on a price chart and placing trades when the price breaks out of these levels.

The concept behind breakout trading is based on the idea that when a price breaks out of a significant level of support or resistance, it tends to continue moving in the same direction with increased momentum. Traders who use this strategy aim to capture these strong moves and profit from them.

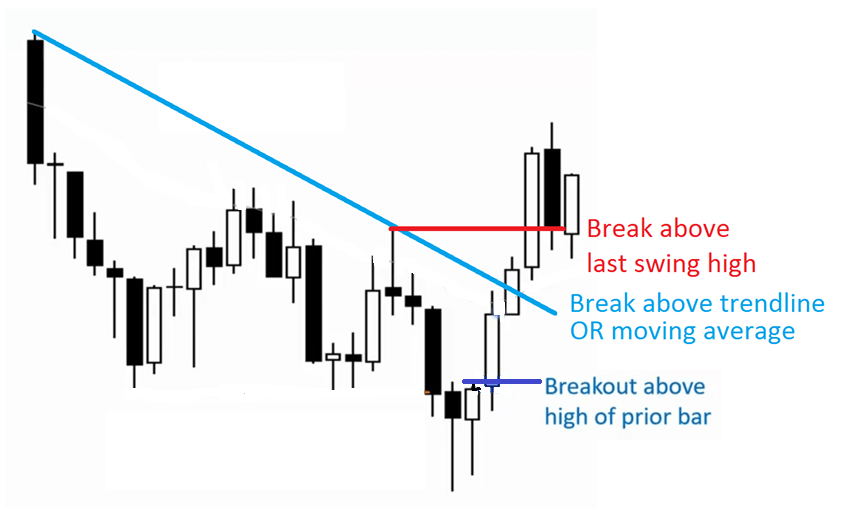

To effectively trade breakouts, traders first need to identify key levels on their charts where prices have historically found support or resistance. These levels can be identified using various technical analysis tools such as trend lines, horizontal support/resistance lines, or moving averages.

Once these levels have been identified, traders wait for the price to break out above a resistance level or below a support level before entering into a trade. This breakout signifies that market sentiment has shifted in favor of the buyers (in case of an upside breakout) or sellers (in case of a downside breakout), indicating potentially strong price movements in that direction.

When entering a breakout trade, it is crucial to consider other factors such as volume and confirmation indicators. High volume during a breakout suggests increased market participation and adds validity to the move. Additionally, confirmation indicators like oscillators can help confirm whether an asset is overbought or oversold after breaking out from its range.

One common approach used by breakout traders is to place stop orders just above the resistance level in case of an upside breakout or below the support level in case of a downside breakout. By doing so, they ensure they enter into positions only if there is sufficient momentum supporting the move.

Another important aspect of successful breakout trading is managing risk through proper position sizing and setting appropriate stop-loss orders. Since breakouts can sometimes result in false moves or temporary pullbacks, it is crucial to have a predetermined exit strategy to protect against potential losses.

Traders can also use additional tools and techniques to enhance their breakout trading strategies. For instance, some traders use volatility indicators like Bollinger Bands to identify periods of high or low volatility, which can help determine the strength of a breakout. Others may combine breakout trading with other technical analysis patterns such as triangles or flags to increase the probability of successful trades.

It’s worth noting that breakout trading has its advantages and disadvantages. On one hand, breakouts offer the potential for substantial profits if caught early on. They allow traders to ride strong trends and capitalize on significant market moves. On the other hand, breakouts can be challenging to trade successfully since false breakouts are not uncommon. Traders need patience and discipline while waiting for genuine breakouts and avoiding getting trapped in false signals.

Additionally, it’s essential for traders employing this strategy to stay updated with relevant news events or economic data releases that could potentially impact their chosen currency pairs. These events can act as catalysts for breakouts by creating increased volatility in the market.

In conclusion, breakout trading is a popular strategy among forex traders due to its ability to capture strong price movements and generate profitable trades. By identifying key levels of support and resistance on price charts and entering positions when these levels are broken with confirmation from volume or other indicators, traders aim to profit from sustained momentum in the direction of the breakout. However, caution must be exercised as false breakouts can occur frequently. Like any trading strategy, proper risk management techniques should always be employed when using this approach.