Distressed Debt Hedge Funds: A Deep Dive into this Alternative Investment Strategy

In the world of finance, there are various investment strategies that cater to different risk appetites and objectives. One such strategy gaining popularity among investors is distressed debt investing, particularly through hedge funds. In this article, we will dive deep into the concept of distressed debt hedge funds and explore their unique characteristics.

Firstly, let’s understand what distressed debt is. Distressed debt refers to bonds or loans issued by companies facing financial distress or going through bankruptcy proceedings. These securities typically trade at a significant discount due to the perceived higher risk associated with them.

Distressed debt hedge funds aim to profit from these discounted opportunities by purchasing such assets and ultimately participating in the company’s restructuring or turnaround process. This investment strategy requires a thorough analysis of the company’s financials, industry position, management capabilities, and potential catalysts for recovery.

One key advantage of investing in distressed debt through hedge funds is professional expertise. These funds employ experienced portfolio managers who specialize in analyzing distressed companies and identifying attractive investments within this space. They have access to extensive networks of legal advisors, industry experts, and other resources that aid in evaluating investment opportunities effectively.

Moreover, investing in a diversified portfolio of distressed assets helps spread out risks across multiple positions rather than being concentrated on a single security or issuer. This diversification provides downside protection while offering potential upside if an investment successfully emerges from distress.

It’s worth noting that distressed debt hedge funds operate with longer-term horizons compared to traditional equity-focused strategies. The nature of corporate restructurings often involves complex processes and can take several years before value realization occurs.

Investing in these types of alternative strategies does come with certain risks though; liquidity being one major concern. Distressed securities may be illiquid as they do not trade frequently on public exchanges like more liquid stocks or bonds do. Additionally, regulatory changes or economic downturns may impact their value and liquidity further.

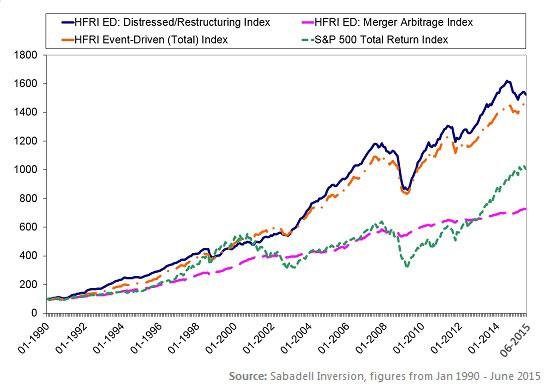

However, for investors with a longer time horizon and a willingness to take on higher risk, distressed debt hedge funds can offer attractive returns. Historically, these funds have generated above-average yields that are uncorrelated to traditional asset classes such as stocks or bonds.

In conclusion, distressed debt hedge funds provide an alternative investment avenue for those seeking potentially high returns within the fixed income space. While they come with their own set of risks, professional management expertise and diversification benefits make them appealing to certain investors. As always, it is crucial to thoroughly research and understand the investment strategy before allocating capital to any specific fund or manager.