A Multi-strategy Hedge Fund: Unlocking the Power of Diversification

In the world of investing, hedge funds are often regarded as exclusive and mysterious vehicles for wealthy individuals and institutional investors. While this perception holds some truth, there is much more to hedge funds than meets the eye. One type of hedge fund that has gained popularity in recent years is the multi-strategy hedge fund.

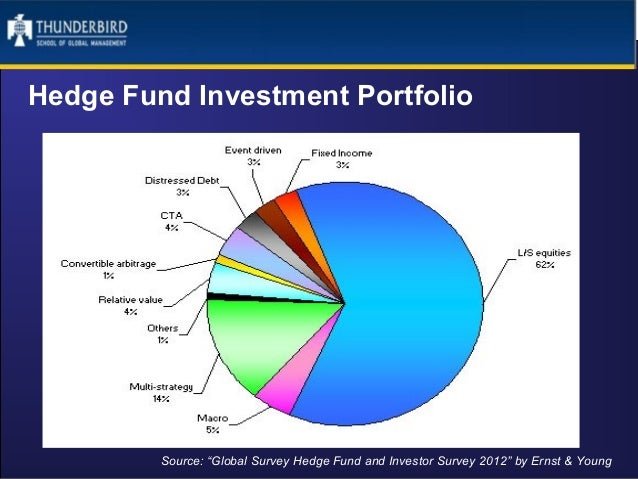

What sets a multi-strategy hedge fund apart from its counterparts is its ability to employ various investment strategies simultaneously. These strategies can range from long/short equity trading to credit arbitrage, global macro investing, and event-driven trading. By diversifying across multiple strategies, these funds aim to generate consistent returns while minimizing risk.

One key advantage of multi-strategy hedge funds lies in their ability to adapt to changing market conditions. Traditional single-strategy funds may struggle when their specific strategy falls out of favor or becomes less effective due to economic or market shifts. In contrast, multi-strategy funds have the flexibility to allocate capital across different strategies based on prevailing market trends and opportunities.

The primary objective of a multi-strategy approach is not only to achieve superior risk-adjusted returns but also to provide downside protection during volatile periods. By including uncorrelated investment strategies within their portfolios, these funds can potentially reduce losses during market downturns while still capturing gains during upswings.

Another benefit offered by multi-strategy hedge funds is access to a broad range of investment opportunities that may be inaccessible through traditional investment avenues. For instance, certain strategies like distressed debt or merger arbitrage require specialized knowledge and expertise that an individual investor might find challenging or impractical to pursue independently.

Moreover, by pooling resources together with other investors in a multi-strategy fund structure, participants gain access not only to diverse investment opportunities but also benefit from economies of scale in terms of transaction costs and research expenses. This allows smaller investors who would typically face higher barriers entry into alternative investment strategies to participate and potentially benefit from the performance of these strategies.

It is important to note that multi-strategy hedge funds are not without risks. As with any investment, there are potential downsides that investors should be aware of. One such risk is the complexity involved in managing multiple strategies simultaneously. This requires a high level of skill, expertise, and experience on the part of fund managers who must navigate various market conditions and accurately assess risk-reward trade-offs across different investment opportunities.

Additionally, while diversification can help mitigate risk, it does not eliminate it entirely. The performance of a multi-strategy hedge fund will still depend on the skill and judgment exercised by its management team when allocating capital across various strategies. Poor decision-making or misjudgment can lead to underperformance or even losses for investors.

When evaluating a multi-strategy hedge fund as an investment option, there are several factors investors should consider. First and foremost is the track record and reputation of the fund’s management team. A successful history of generating consistent returns over time demonstrates competence in navigating different market environments.

Investors should also carefully review the specific strategies employed within the fund’s portfolio to ensure they align with their own risk tolerance and investment objectives. Some funds may focus more heavily on aggressive trading strategies, while others may have a more conservative approach with an emphasis on capital preservation.

Furthermore, understanding how fees are structured is crucial when investing in hedge funds. Multi-strategy funds typically charge both management fees (based on assets under management) and performance fees (a percentage of profits). It is essential to evaluate whether these fees align with anticipated returns and whether they are reasonable given industry standards.

In conclusion, multi-strategy hedge funds offer investors unique advantages through their diversified approach to investing across multiple strategies simultaneously. By harnessing this diversity, these funds aim to generate consistent returns while minimizing downside risks during volatile periods. However, potential investors must conduct thorough due diligence before committing capital to a multi-strategy hedge fund, considering factors such as the fund’s track record, strategy alignment, and fee structure. With careful consideration and informed decision-making, investors can potentially unlock the power of diversification provided by multi-strategy hedge funds in their pursuit of financial success.