Fixed Exchange Rate Systems:

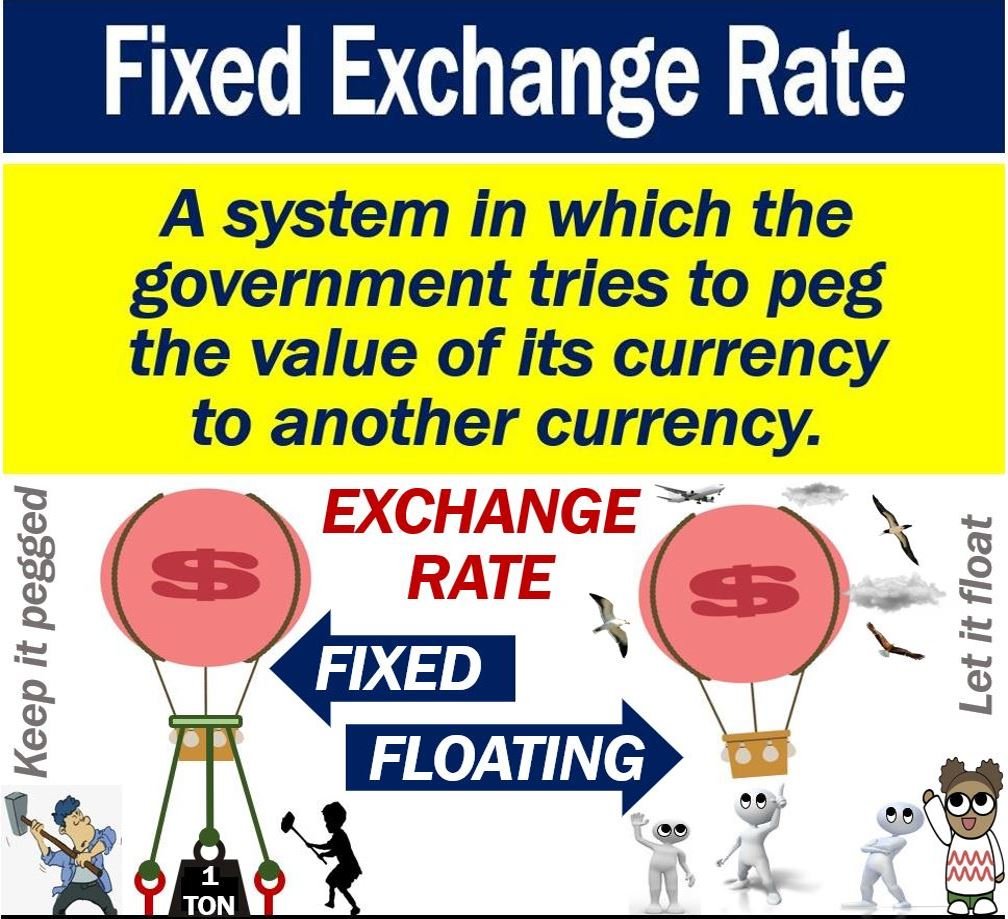

A fixed exchange rate system is a monetary arrangement where the value of a currency is pegged to another currency, a basket of currencies, or even a commodity like gold. In this system, the central bank intervenes in the foreign exchange market to maintain the exchange rate within a narrow band.

One of the most well-known examples of a fixed exchange rate system is the Bretton Woods system established after World War II. Under this system, major currencies were pegged to the U.S. dollar and could be exchanged for gold at a fixed rate. The stability provided by fixed exchange rates was intended to promote international trade and economic stability.

While fixed exchange rate systems can provide stability and predictability for businesses engaged in international trade, they also require significant interventions by central banks to maintain the desired exchange rate. These interventions often involve buying or selling foreign currencies using domestic reserves or adjusting interest rates.

Managed Floating Exchange Rates:

Managed floating exchange rates are flexible but with some degree of intervention from central banks to influence their value. Unlike completely free-floating currencies, managed float allows central banks to intervene in foreign exchange markets when necessary.

In this regime, central banks may use various tools such as open market operations or direct currency purchases/sales to manage their currency’s value relative to other currencies. This approach allows countries greater flexibility in responding to economic shocks while still maintaining some control over their currency’s value.

Crawling Peg Exchange Rate Regimes:

Crawling pegs are similar to fixed exchange rate systems but allow for gradual adjustments over time rather than strict adherence to a specific rate. Under crawling pegs, authorities periodically adjust the official exchange rate based on predetermined criteria such as inflation differentials or balance of payments considerations.

This approach aims to strike a balance between maintaining stability and allowing for gradual adjustments that reflect changing economic fundamentals. It provides more flexibility compared to rigidly fixed systems but less volatility than freely floating regimes.

Currency Boards:

Currency boards are monetary systems where a country’s currency is fully backed by a reserve of foreign currency, typically a major international currency like the US dollar or euro. The central bank of the country operates as a currency board and guarantees the convertibility of domestic currency into the anchor currency at a fixed exchange rate.

The key feature of currency boards is their commitment to maintaining the fixed exchange rate through strict adherence to the backing reserve requirements. This system provides credibility and stability but limits monetary policy autonomy since changes in money supply must be fully supported by changes in reserves.

Dollarization:

Dollarization refers to the adoption of a foreign currency, usually the US dollar, as an official legal tender alongside or instead of a domestic currency. Dollarized economies give up control over their monetary policy and rely on another country’s central bank for stability.

The primary motivation behind dollarization is often economic instability or hyperinflation that erodes confidence in domestic currencies. By adopting a stable foreign currency, countries aim to stabilize prices, attract investment, and promote trade with trading partners using that same foreign currency.

Exchange Rate Pass-Through:

Exchange rate pass-through refers to how changes in exchange rates impact import and export prices and subsequently affect inflation within an economy. When there is complete pass-through, any change in exchange rates directly translates into equivalent price changes for imported goods.

In reality, however, pass-through can vary depending on factors such as market structure, competition levels, pricing strategies adopted by firms, and even government policies like tariffs or subsidies. In some cases, businesses may absorb part of the exchange rate fluctuations rather than passing them onto consumers immediately.

Purchasing Power Parity (PPP):

Purchasing power parity (PPP) theory suggests that in the long run, exchange rates between two countries should adjust so that identical goods have similar prices when expressed in common currencies. PPP serves as an indicator for whether currencies are overvalued or undervalued.

The theory is based on the idea that a currency’s value should reflect its purchasing power, meaning it can buy an equivalent basket of goods in different countries. If PPP holds, exchange rate changes should compensate for differences in inflation rates between countries and equalize the cost of goods over time.

Real Effective Exchange Rates (REER):

The real effective exchange rate (REER) is a measure that reflects the value of a country’s currency against a weighted average of other currencies, adjusted for inflation. It provides insights into whether a currency is overvalued or undervalued relative to its trading partners.

By considering both nominal exchange rates and price levels, REER captures changes in competitiveness due to factors like inflation differentials and productivity growth. A higher REER indicates an appreciation of the domestic currency, potentially making exports more expensive and imports cheaper.

Exchange Rate Volatility and Risk Management Strategies:

Exchange rate volatility refers to fluctuations in the value of one currency compared to another over time. This volatility can create uncertainties for businesses engaged in international trade as it affects their costs, revenues, and profitability.

To manage exchange rate risk effectively, businesses may adopt various strategies such as hedging through forward contracts or options contracts. These financial instruments allow companies to lock-in future exchange rates, reducing their exposure to fluctuations.

Additionally, businesses may engage in natural hedging by diversifying their markets or sourcing inputs locally when possible. By reducing dependence on a single market or currency, firms can mitigate potential losses from adverse exchange rate movements.

Currency Manipulation and Its Impact on Exchange Rates:

Currency manipulation refers to actions taken by governments or central banks that intentionally influence the value of their country’s currency against others. These actions often involve buying or selling large amounts of foreign currencies with domestic reserves to artificially alter supply and demand dynamics in foreign exchange markets.

The impact of currency manipulation on exchange rates can be significant. By increasing demand for its own currency or suppressing demand for others, a manipulating country can cause its currency to appreciate or depreciate relative to other currencies. This manipulation can affect trade flows and competitiveness, leading to potential economic imbalances.

Exchange Rate Forecasting Techniques:

Forecasting exchange rates is a challenging task due to the complex interplay of various factors like economic fundamentals, investor sentiment, geopolitical events, and market expectations. Numerous techniques are used by analysts and traders to predict future exchange rate movements.

Some popular forecasting methods include technical analysis (using historical price patterns), fundamental analysis (considering macroeconomic indicators), and econometric models that capture relationships between variables affecting exchange rates. However, it’s important to note that no method guarantees accurate predictions consistently, as markets can be influenced by unexpected events or behavioral biases.

The Role of Central Banks in Influencing Exchange Rates:

Central banks play a significant role in influencing exchange rates through their monetary policy decisions. They can intervene directly in foreign exchange markets by buying or selling currencies to influence supply and demand dynamics.

Additionally, central banks use interest rate adjustments as a tool for managing exchange rates indirectly. Higher interest rates tend to attract foreign investors seeking better returns on their investments, increasing demand for the domestic currency and potentially appreciating its value.

Central banks also communicate their stance on monetary policy through forward guidance or official statements. These communications impact market expectations and may lead to changes in exchange rates if they differ from what was anticipated.

Exchange Rate Regimes and Economic Stability:

The choice of an appropriate exchange rate regime is crucial for maintaining economic stability within a country. The stability of an economy depends on factors such as inflation control, balance of payments equilibrium, confidence in the domestic currency, and competitiveness of exports.

Different regimes offer varying degrees of stability depending on the specific circumstances faced by an economy. Fixed systems provide certainty but require constant intervention while floating systems allow flexibility but may introduce volatility if not effectively managed.

Countries must carefully consider their unique characteristics before choosing an exchange rate regime that aligns with their economic goals and capabilities.

Cross-Border Trade and Its Relationship with Exchange Rates:

Exchange rates play a crucial role in cross-border trade as they determine the relative prices of goods and services between countries. Fluctuations in exchange rates can impact the competitiveness of exports and imports, influencing trade volumes and patterns.

A depreciation in the domestic currency can make exports more competitive by reducing their price when converted into foreign currencies. Conversely, an appreciation may lead to higher import costs, potentially affecting consumer prices or profit margins for businesses reliant on imported inputs.

Exchange rate movements also influence terms of trade, which is the ratio between export prices and import prices. Improvements in terms of trade due to favorable exchange rate movements can boost a country’s economic performance.

The Impact of Political Events on Exchange Rates:

Political events can significantly impact exchange rates as they introduce uncertainties about future policies, regulations, or geopolitical relationships. Elections, changes in government leadership, geopolitical tensions, or policy announcements all have the potential to influence market sentiment towards a currency.

Investors closely monitor political developments as they assess potential risks or opportunities. A stable political environment often contributes to greater confidence in a country’s currency while political instability may result in increased volatility or capital flight.

Carry Trade Strategies and Their Implications for Exchange Rates:

Carry trade strategies involve borrowing funds from countries with low-interest rates (e.g., Japan) and investing them in countries with higher interest rates (e.g., Australia). The goal is to profit from both interest rate differentials and potential currency appreciation.

This strategy affects exchange rates since it involves substantial buying pressure on high-yielding currencies compared to low-yielding ones. As investors engage in carry trades by purchasing assets denominated in higher-yielding currencies, demand for those currencies increases relative to others.

However, carry trades also expose investors to risks if interest rate differentials change suddenly or if there is unexpected depreciation of the high-yielding currency. The potential unwinding of carry trades can lead to sharp exchange rate movements, particularly if many investors exit their positions simultaneously.

Exchange Rate Overshooting Theory:

Exchange rate overshooting theory, developed by economist Rudi Dornbusch, suggests that in the short run, exchange rates can deviate significantly from their long-run equilibrium values. This temporary overshooting occurs due to sticky prices and imperfect adjustment mechanisms in goods and financial markets.

According to this theory, when there are shocks such as changes in interest rates or monetary policy, exchange rates initially move more than what would be justified by fundamental factors. Over time, as prices adjust and market forces operate more fully, exchange rates gradually converge towards their long-term equilibrium values.

The Impact of Interest Rates on Currency Values:

Interest rates have a significant impact on currency values as they influence capital flows between countries. Higher interest rates generally attract foreign investors seeking higher yields on their investments. As a result, demand for the domestic currency increases relative to others.

Conversely, lower interest rates reduce the attractiveness of investing in a country’s assets compared to other countries with higher yields. This can lead to capital outflows and depreciation pressure on the domestic currency.

Central banks often use changes in interest rates as a tool for managing inflation or stimulating economic growth while being mindful of its impact on exchange rates.

Currency Swaps and Their Role in Managing Foreign Exchange Risk:

Currency swaps are financial instruments used by businesses or governments to manage foreign exchange risk associated with cross-border transactions or investments denominated in different currencies.

In a typical currency swap agreement, two parties agree to exchange principal amounts denominated in different currencies while also agreeing upon an exchange rate at which they will reverse this transaction at maturity. Currency swaps allow entities engaged in international activities to mitigate potential losses arising from adverse movements in exchange rates over time.

By locking-in future conversion rates through swaps contracts, businesses can effectively manage their exposure to foreign exchange risk, providing greater certainty in planning and budgeting.

The Relationship Between Inflation and Exchange Rates:

Inflation has a significant impact on exchange rates as it influences the purchasing power of a currency. Countries with higher inflation rates generally experience depreciation in their currencies, reflecting the decreased value of each unit of domestic currency relative to other currencies.

This relationship is based on the concept of purchasing power parity (PPP), which suggests that changes in inflation differentials between countries should be reflected in exchange rate movements over time. Higher inflation erodes a country’s competitiveness by increasing costs and reducing export competitiveness.

However, factors beyond inflation can also influence exchange rates, such as interest rate differentials, market sentiment, or geopolitical developments. Therefore, while there is a theoretical link between inflation and exchange rates through PPP, it may not hold precisely in practice due to various complicating factors.