As a single parent, managing your finances can be challenging. One important aspect of personal finance is credit utilization. Understanding how to effectively use and manage your credit can help you maintain a healthy financial life. Here are some tips for single parents on credit utilization.

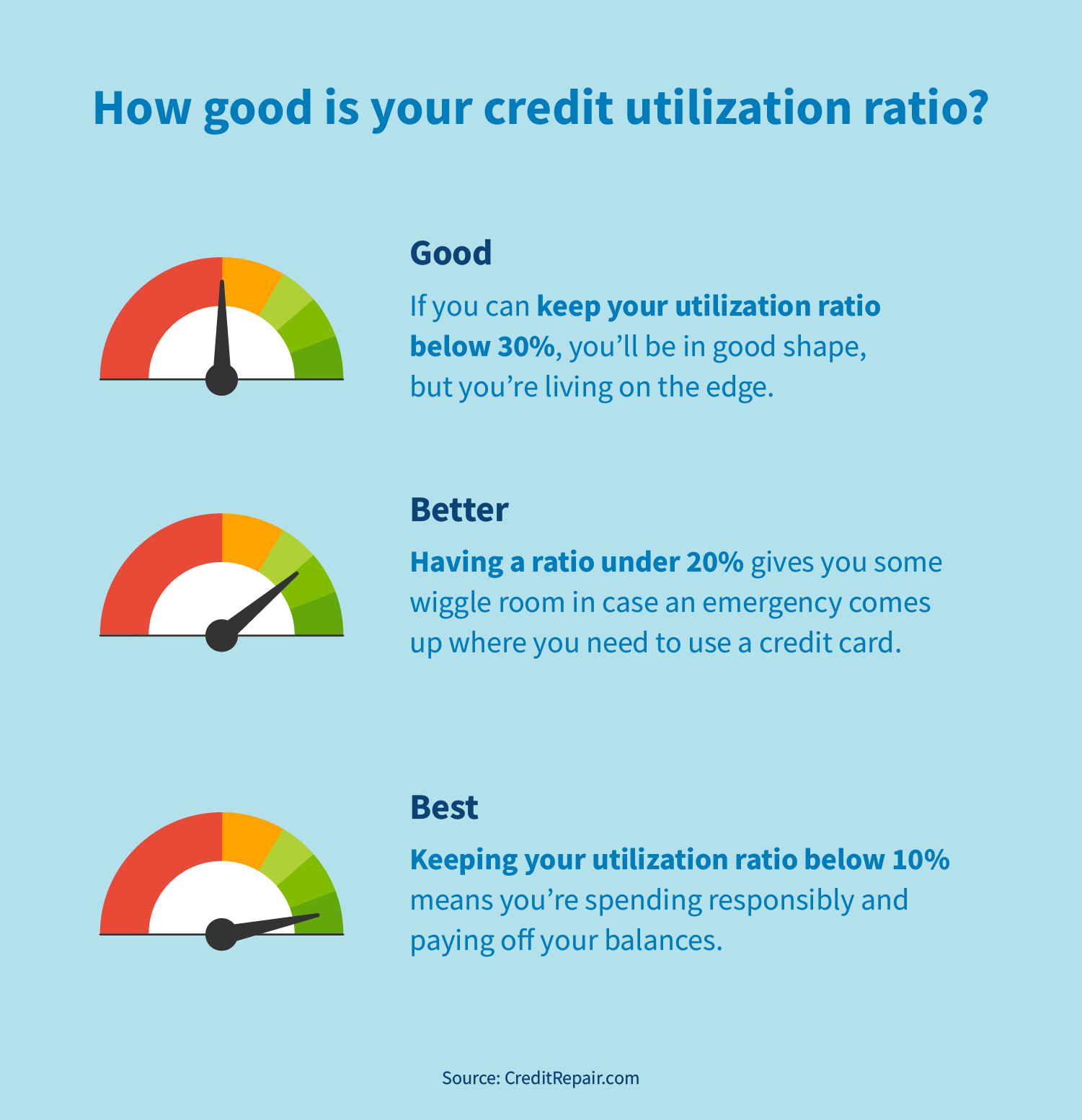

Firstly, it’s crucial to understand what credit utilization means. It refers to the percentage of your available credit that you’re currently using. To calculate it, divide your outstanding balance by your total available credit limit and multiply by 100. A lower credit utilization ratio is generally better for your overall financial health.

To keep your credit utilization in check, try to pay off any existing debts as much as possible. Aim to keep your balances low and avoid maxing out any of your accounts. This demonstrates responsible borrowing habits and reflects positively on your credit score.

Another useful strategy is applying for a higher credit limit on one or more of your cards while maintaining the same level of spending or debt repayment each month. This will effectively decrease your overall usage percentage without needing to reduce spending drastically.

Additionally, consider keeping old accounts open even if they’re not actively being used. Closing an account reduces the total amount of available credit you have access to, which can negatively impact your utilization ratio.

Lastly, regularly monitoring and reviewing all aspects of your financial health will help ensure that you stay on top of things and make necessary adjustments when needed.

In conclusion, understanding how to utilize and manage credit wisely is essential for single parents looking to build strong financial foundations. By paying down debts, maintaining low balances, increasing limits strategically, keeping old accounts open, and monitoring their financial health closely; single parents can set themselves up for long-term success in managing their finances responsibly!