Liquidity ratios are an important tool used in personal finance to assess the financial health and stability of individuals or businesses. These ratios measure a company’s ability to meet its short-term obligations and provide insight into its overall liquidity position.

The first key liquidity ratio is the current ratio, which compares current assets with current liabilities. This ratio helps determine if a company has enough assets that can be quickly converted into cash to cover its short-term debts. A higher current ratio indicates better liquidity, as it suggests that there are sufficient assets available to pay off immediate obligations.

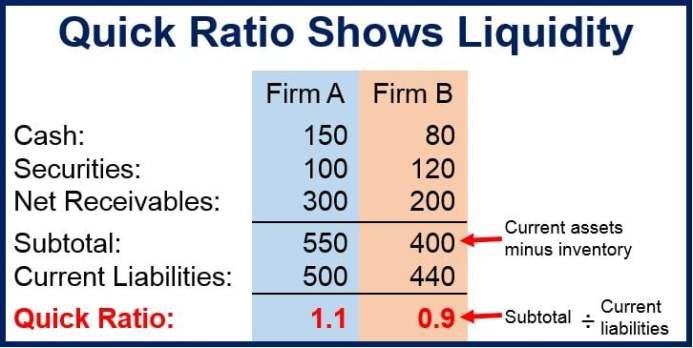

Another important liquidity ratio is the quick ratio, also known as the acid-test ratio. It considers only the most liquid assets like cash, marketable securities, and accounts receivable compared to current liabilities. By excluding inventory from the equation, this ratio provides a more conservative view of a company’s short-term liquidity position.

Furthermore, the cash ratio measures a company’s ability to cover its immediate liabilities with just cash and cash equivalents on hand. It demonstrates whether an entity could settle all debts without relying on other sources of liquidity such as selling inventory or collecting receivables.

Lastly, we have the operating cash flow (OCF) ratio which determines how well a business generates cash from its operations relative to its net sales revenue. A high OCF ratio indicates strong operational efficiency and healthy prospects for meeting financial obligations promptly.

These various liquidity ratios help individuals make informed decisions about their personal finances by assessing their ability to handle short-term expenses or emergencies effectively. By maintaining healthy levels of these ratios, individuals can ensure they have enough liquid assets readily available when needed while minimizing potential financial risks.