Deflation and Business Investment: Understanding the Relationship

In the world of economics, deflation is often viewed as a cause for concern. It refers to a persistent decrease in general price levels across an economy over an extended period. While this may sound like good news for consumers who can purchase goods and services at lower prices, it can have adverse effects on businesses and overall economic growth.

One area where deflation can significantly impact is business investment. When prices are falling, businesses experience reduced revenue and profit margins, which can discourage them from making new investments or expanding their operations. Let’s delve deeper into the relationship between deflation and business investment.

Firstly, during periods of deflation, consumer demand tends to decline as people postpone purchases in anticipation of even lower prices in the future. This reduction in demand affects businesses directly by reducing sales revenues. Businesses then face a difficult decision regarding whether to invest in new projects or equipment when they are unsure about future customer demand.

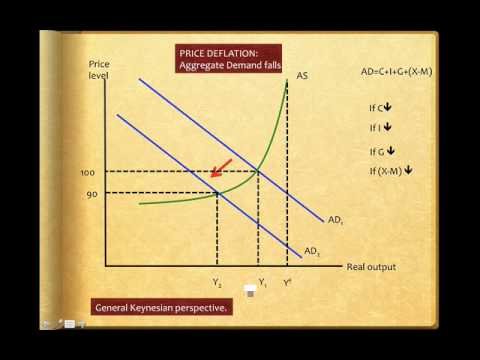

Secondly, declining prices coupled with reduced consumer spending create a vicious cycle that hampers economic growth. Falling aggregate demand leads to reduced production levels and layoffs, resulting in higher unemployment rates. As job security becomes uncertain, individuals become more cautious with their spending habits, further exacerbating the decrease in consumer demand.

Furthermore, falling prices erode profit margins for businesses since they cannot reduce costs at the same rate as declining sales revenue. Lower profitability means less money available for investment purposes such as research and development (R&D), technology upgrades, or capacity expansion. In turn, these lowered investments hinder innovation and productivity improvements that could propel long-term economic growth.

Interestingly though there are instances when deflation does not necessarily dampen business investment activity but rather spurs it on. This occurs when technological advancements lead to cost reductions through increased efficiency or productivity gains that outweigh falling product prices.

For example, imagine a manufacturing company that adopts advanced automation technologies allowing them to produce goods at a significantly lower cost. If prices for those goods also decrease due to deflation, the company can maintain or even improve profit margins while simultaneously increasing sales volume. In this scenario, businesses may be more inclined to invest in such technologies during deflationary periods.

However, it is important to note that these situations are not always the norm and depend on various factors such as industry-specific conditions and overall economic stability. Deflation typically brings uncertainty and financial instability, making businesses cautious about long-term investments.

To combat the adverse effects of deflation on business investment, governments and central banks often employ expansionary monetary policies. Through interest rate cuts or quantitative easing programs, they aim to stimulate borrowing and spending to increase consumer demand. Additionally, fiscal policies like tax cuts or infrastructure spending can boost aggregate demand directly.

In conclusion, while falling prices may seem appealing for consumers at first glance, deflation poses significant challenges for businesses and their investment activities. Reduced consumer demand and profitability constraints discourage new investments and hinder economic growth. However, under certain circumstances where technological advancements lead to cost reductions that outweigh falling prices, some sectors might see increased business investment during deflationary periods. Overall though, policymakers play a crucial role in implementing measures that counteract the negative impact of deflation on business investment in order to promote sustainable economic growth.