When it comes to buying a home, one of the biggest hurdles for many prospective buyers is coming up with the down payment. The down payment is a lump sum of money that you pay upfront towards the purchase price of the property. It not only reduces the amount you need to borrow but also serves as an indication of your financial stability and commitment to homeownership.

While traditionally, a 20% down payment has been considered standard, there are several options and strategies available today that can help you navigate this expense more easily. In this article, we will explore different mortgage down payment options and strategies that can make homeownership more accessible.

1. Saving for a Down Payment:

One common method is saving money over time specifically for the purpose of making a down payment on a home. This approach allows you to have full control over your funds without incurring any additional debt or obligations. Here are some tips for saving effectively:

a) Create a budget: Assess your income and expenses to determine how much you can save each month.

b) Set up automatic transfers: Arrange automatic transfers from your checking account into a separate savings account dedicated solely to accumulating funds for your down payment.

c) Cut unnecessary expenses: Identify areas where you can reduce spending and redirect those savings towards your goal.

d) Explore high-yield savings accounts: Look for savings accounts that offer competitive interest rates so that your money grows faster.

2. Government Programs:

Various government programs exist to assist first-time homebuyers by providing low or no-down-payment options, which can significantly reduce the financial burden at the outset. Some popular programs include:

a) Federal Housing Administration (FHA) loans: Backed by the U.S Department of Housing and Urban Development (HUD), FHA loans typically require only 3.5% down payments.

b) Veterans Affairs (VA) loans: Exclusively available to eligible military personnel, VA loans often require no down payment at all.

c) United States Department of Agriculture (USDA) loans: Aimed at individuals in rural areas, USDA loans offer zero-down-payment options.

3. Conventional Loans:

While conventional mortgages typically require a 20% down payment, there are alternatives to help buyers who cannot meet this requirement:

a) Private Mortgage Insurance (PMI): If you can afford a smaller down payment but not 20%, PMI allows you to borrow with less money upfront. However, keep in mind that PMI adds an additional cost to your monthly mortgage payments.

b) Lender-Paid Mortgage Insurance (LPMI): With LPMI, the lender pays the insurance premium upfront instead of the borrower. This eliminates the need for monthly PMI payments but may come with a higher interest rate.

c) Piggyback Loans: Also known as second mortgages or home equity lines of credit (HELOC), piggyback loans involve taking out two separate loans simultaneously – one for the primary mortgage and another for a portion or all of the down payment.

4. Down Payment Assistance Programs:

Many states, cities, and nonprofit organizations offer down payment assistance programs to help low-to-moderate-income individuals purchase homes. These programs provide grants or low-interest loans specifically for down payments and closing costs. Research local resources or consult with a housing counselor to explore these opportunities.

5. Employer Assistance:

Some employers provide homeownership assistance as part of their employee benefits package. This can include matching funds towards your down payment savings or providing access to special loan programs designed exclusively for employees.

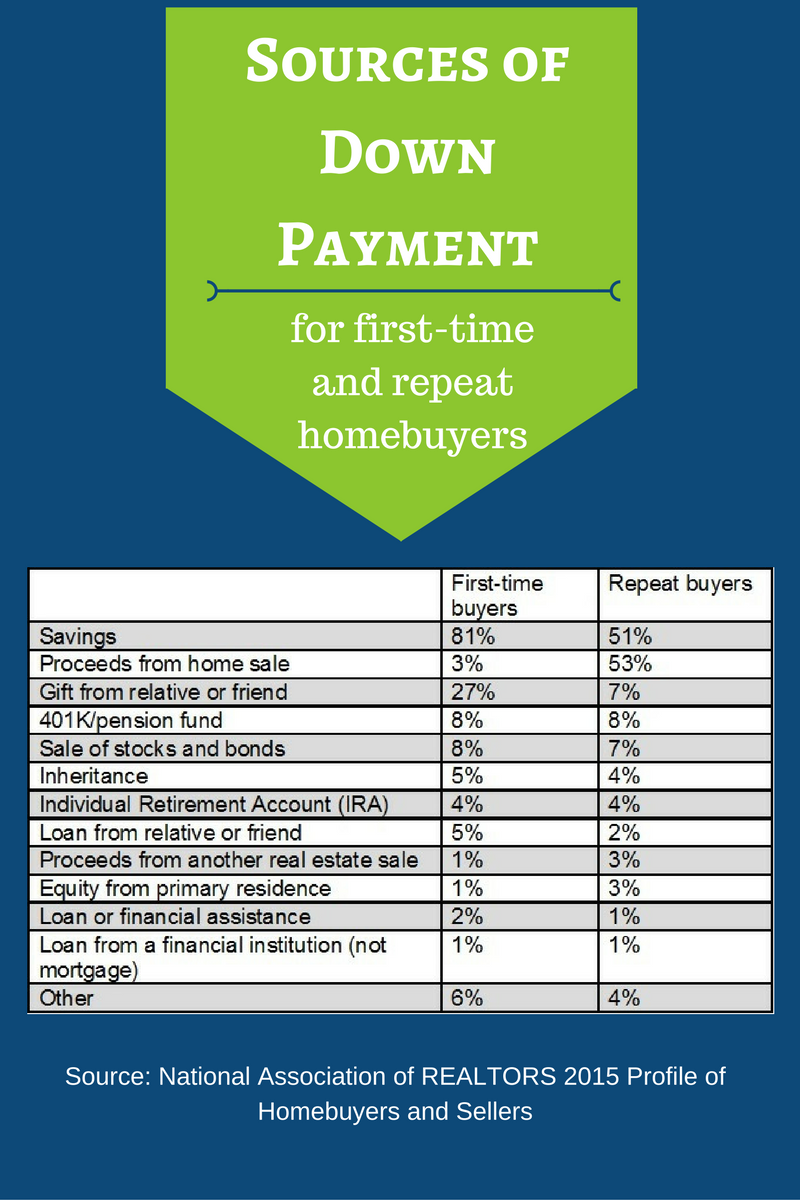

6. Gift Funds:

If you have family members willing and able to assist financially, gift funds can be used towards your down payment. However, it’s important to follow specific guidelines when using gift funds as lenders generally require documentation proving that the money is indeed a gift and not an additional loan obligation.

7. Negotiating with Sellers:

In certain cases, especially in a buyer’s market, you may be able to negotiate with the seller to contribute towards your down payment or closing costs. This can help alleviate some of the financial burden and make homeownership more affordable.

In conclusion, while saving for a 20% down payment is ideal, it is not always necessary or feasible for everyone. By exploring alternative options such as government programs, conventional loan alternatives, down payment assistance programs, and employer assistance, you can find strategies that suit your financial situation and make purchasing a home more attainable. Remember to carefully consider the pros and cons of each option before making a decision that aligns with your long-term financial goals.