Liquidity Ratios: Understanding the Financial Health of a Company

In the world of finance, understanding a company’s financial health is crucial before making any investment decisions. One essential aspect to consider is liquidity – the ability of a company to meet its short-term obligations. Liquidity ratios play a vital role in assessing this capability and provide investors with valuable insights into a company’s financial stability. In this article, we will explore some commonly used liquidity ratios and their significance.

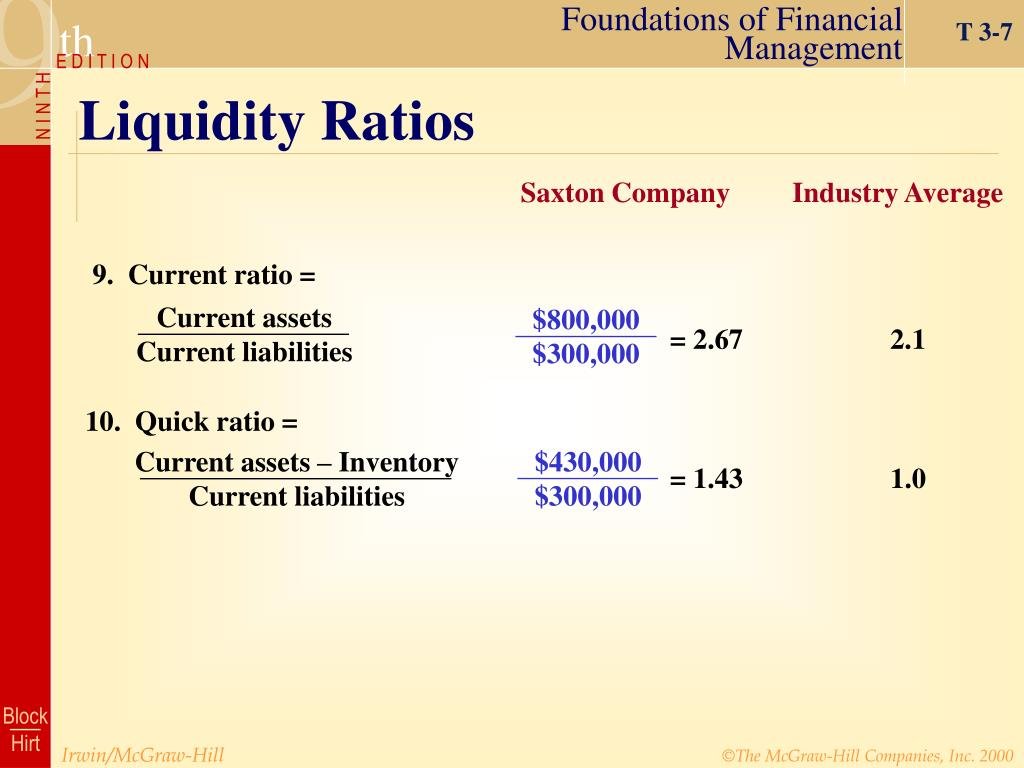

The current ratio is one of the most straightforward liquidity ratios and measures a company’s ability to cover short-term liabilities with its short-term assets. It is calculated by dividing current assets by current liabilities. Generally, a higher ratio indicates better short-term solvency, as it implies that the company has sufficient resources to cover its immediate obligations.

Another widely used liquidity ratio is the quick ratio (also known as acid-test ratio). This ratio provides a more conservative measure than the current ratio by excluding inventory from current assets since inventory may not be easily converted into cash in case of an emergency or financial distress. The quick ratio is computed by subtracting inventories from current assets and then dividing them by current liabilities.

While both the current and quick ratios focus on short-term liquidity, it’s also important to consider long-term obligations when evaluating a company’s financial position. This brings us to another key liquidity indicator called the cash ratio. As its name suggests, this metric assesses how much cash and cash equivalents are available to meet immediate liabilities without relying on selling any other assets promptly.

Apart from these primary liquidity ratios, there are others worth mentioning for additional insights into overall financial health. The working capital ratio compares a firm’s total current assets against its total current liabilities but takes into account seasonal fluctuations in business activities or cyclical industries where companies require more working capital at certain times during their operations.

The operating cash flow (OCF) ratio evaluates how well a company generates cash flow from its core operations to meet its obligations. It is calculated by dividing OCF by current liabilities, providing an indication of how easily a company can cover short-term commitments without relying on external financing.

While liquidity ratios are valuable tools for assessing a company’s financial health, it is crucial to interpret them in the context of the industry and the specific company being analyzed. Comparing liquidity ratios with competitors or historical data can provide further insights into trends and potential strengths or weaknesses.

In conclusion, liquidity ratios serve as essential indicators when evaluating a company’s financial stability and ability to meet short-term obligations. The current ratio, quick ratio, cash ratio, working capital ratio, and operating cash flow (OCF) ratio are some commonly used metrics that help investors gain insights into a company’s liquidity position. However, it is crucial not to rely solely on these ratios but instead consider them alongside other financial indicators when making investment decisions. By understanding these liquidity metrics and their significance, investors can make more informed choices about where to allocate their funds based on the financial health of companies they wish to invest in.