Accounting for Research and Development Costs

In the world of business, staying ahead of the competition is crucial. Companies are constantly striving to innovate and improve their products or services to meet ever-changing customer demands. Research and development (R&D) plays a vital role in this process, as it involves activities aimed at creating new knowledge or improving existing technology.

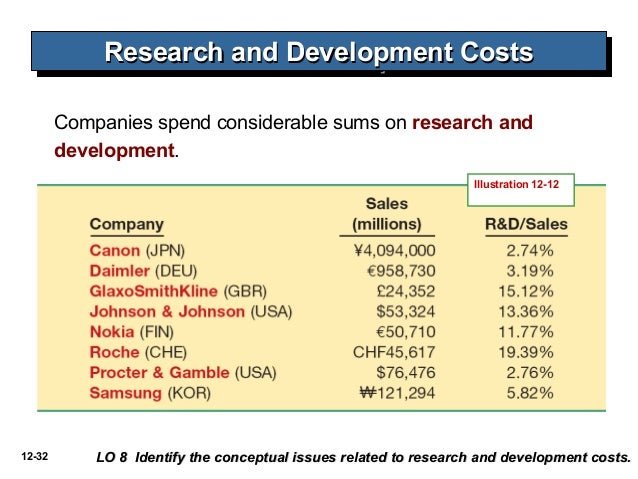

However, conducting R&D can be an expensive endeavor, involving significant costs such as salaries for scientists and engineers, laboratory equipment, materials, and other related expenses. As a result, accounting for research and development costs becomes essential to accurately reflect the financial impact of these activities on a company’s books.

Traditionally, there have been two methods used to account for R&D costs: expensing and capitalization.

1. Expensing: Under this method, all R&D expenses are immediately recognized as operating expenses in the period they occur. This approach allows companies to match their expenses with revenues generated during that period accurately. By expensing R&D costs upfront, companies can demonstrate transparency in their financial statements by reflecting the true cost of innovation on their income statement.

2. Capitalization: Alternatively, some companies choose to capitalize certain R&D costs by treating them as long-term assets rather than immediate expenses. These capitalized costs are then amortized over time based on estimated economic benefits derived from the research efforts. The rationale behind capitalizing R&D is that it provides a more accurate representation of its future value through improved products or processes.

To determine whether certain R&D expenditures should be capitalized or expensed requires careful consideration of several factors:

a) Technological Feasibility: Before any project can be considered capitalizable under generally accepted accounting principles (GAAP), it must reach a stage where its outcome is both probable and technically feasible.

b) Intentionality: The company must demonstrate intent to complete the project.

c) Economic Benefits: There must be potential economic benefits associated with completing the project.

d) Ability to Measure Costs: The costs incurred during the R&D process should be measurable reliably.

e) Control Over Assets: The company must have control over the asset or intellectual property being developed.

It is important to note that different countries and accounting standards may have specific guidelines and regulations regarding R&D cost accounting. For example, under United States Generally Accepted Accounting Principles (US GAAP), all R&D expenses are treated as current period expenses and expensed immediately. In contrast, International Financial Reporting Standards (IFRS) allow for capitalization of certain development costs.

The choice between expensing and capitalizing R&D costs can significantly impact a company’s financial statements. Expensing leads to higher immediate expenses, which may reduce reported profitability in the short term but accurately reflects the true cost of innovation. Capitalization, on the other hand, increases assets on the balance sheet but spreads out the expense recognition over time through amortization.

Investors and stakeholders analyze financial statements to assess a company’s financial health and performance. Therefore, it is crucial for companies to provide sufficient disclosures accompanying their financial statements regarding their accounting policies for R&D costs.

In conclusion, accounting for research and development costs is a complex task that requires careful consideration of various factors such as technological feasibility, intentionality, economic benefits, ability to measure costs reliably, and control over assets. Companies must choose between expensing or capitalizing these costs based on applicable accounting standards while ensuring transparency in their reporting practices. By accurately reflecting R&D expenditures in their financial statements, companies can demonstrate their commitment to innovation while providing investors with an accurate picture of their financial position.