What is Useful Life of an Asset?

The useful life of an asset refers to the estimated duration that an asset will be productive and generate economic benefits for its owner. It is a concept widely used in accounting and finance to determine how long an asset is expected to be in service before it becomes obsolete or no longer economically viable.

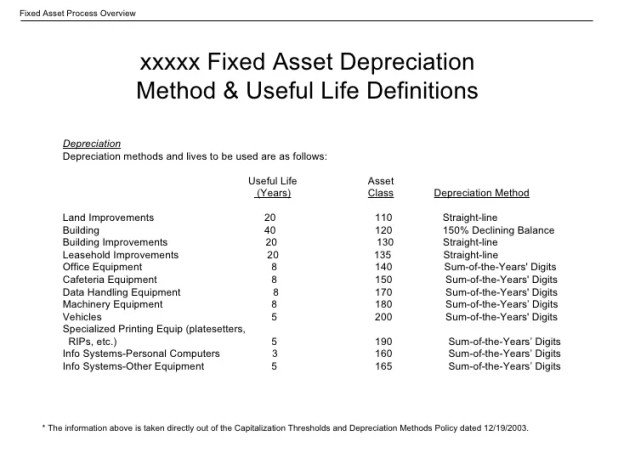

Determining the useful life of an asset is crucial for various reasons. From a business perspective, it helps companies estimate the depreciation expenses associated with the asset over its lifespan. This information aids in strategic decision-making, such as whether to repair or replace an existing asset, budgeting for future purchases, and understanding overall financial health.

Factors Affecting Useful Life

Several factors can influence the useful life of an asset. These include technological advancements, wear and tear, maintenance practices, environmental conditions, legal restrictions, and changes in market demand. For example, technological obsolescence might significantly reduce the useful life of a computer system or software program since newer versions are constantly being developed.

Different Types of Assets

Assets can be categorized into tangible and intangible assets when considering their useful life. Tangible assets are physical items such as buildings, machinery, vehicles, furniture, or equipment. The useful life of tangible assets depends on factors like quality construction materials used during manufacturing and regular maintenance efforts.

Intangible assets encompass non-physical items like patents, copyrights, trademarks, brand names – essentially anything that has value but does not have a physical presence. Unlike tangible assets that degrade over time due to wear and tear or aging components breaking down physically – intangible assets typically do not deteriorate with use alone; they may become outdated due to changing market demands.

Estimating Useful Life

Estimating the useful life of an asset involves analyzing historical data about similar assets within similar industries/markets while also considering external factors that may impact longevity (e.g., technological advancements). Industry guidelines may exist for estimating average lifespans, but it is crucial to conduct a detailed analysis specific to your asset and its operating conditions.

It is essential to understand that useful life estimates are not set in stone. They serve as educated predictions based on current knowledge and understanding. As time progresses, new information may emerge that affects the estimated useful life of an asset. Therefore, it is prudent to regularly review and update these estimations to ensure accuracy.

Conclusion

The concept of useful life provides valuable insights into managing assets effectively from both personal and business perspectives. By estimating the duration an asset will remain productive, individuals can plan for replacements or repairs while businesses can make informed decisions regarding capital expenditure budgets. Understanding factors affecting useful life aids in better management of tangible and intangible assets, ensuring maximum economic benefits throughout their lifespan.