Tracking and Monitoring Capital Expenditures: The Key to Financial Success

In the realm of personal finance, it is crucial to have a clear understanding of your expenses and how they impact your financial well-being. While many people focus on tracking day-to-day expenses such as groceries or entertainment, it is equally important to monitor and track capital expenditures. These are significant investments made in assets that generate long-term benefits, such as buying a house, renovating your property, purchasing a vehicle, or starting a business.

Why should you bother with tracking and monitoring capital expenditures? Well, by doing so, you gain valuable insights into how these investments affect your overall financial health. It allows you to make informed decisions about future purchases while ensuring that you are maximizing the returns on your capital outlay.

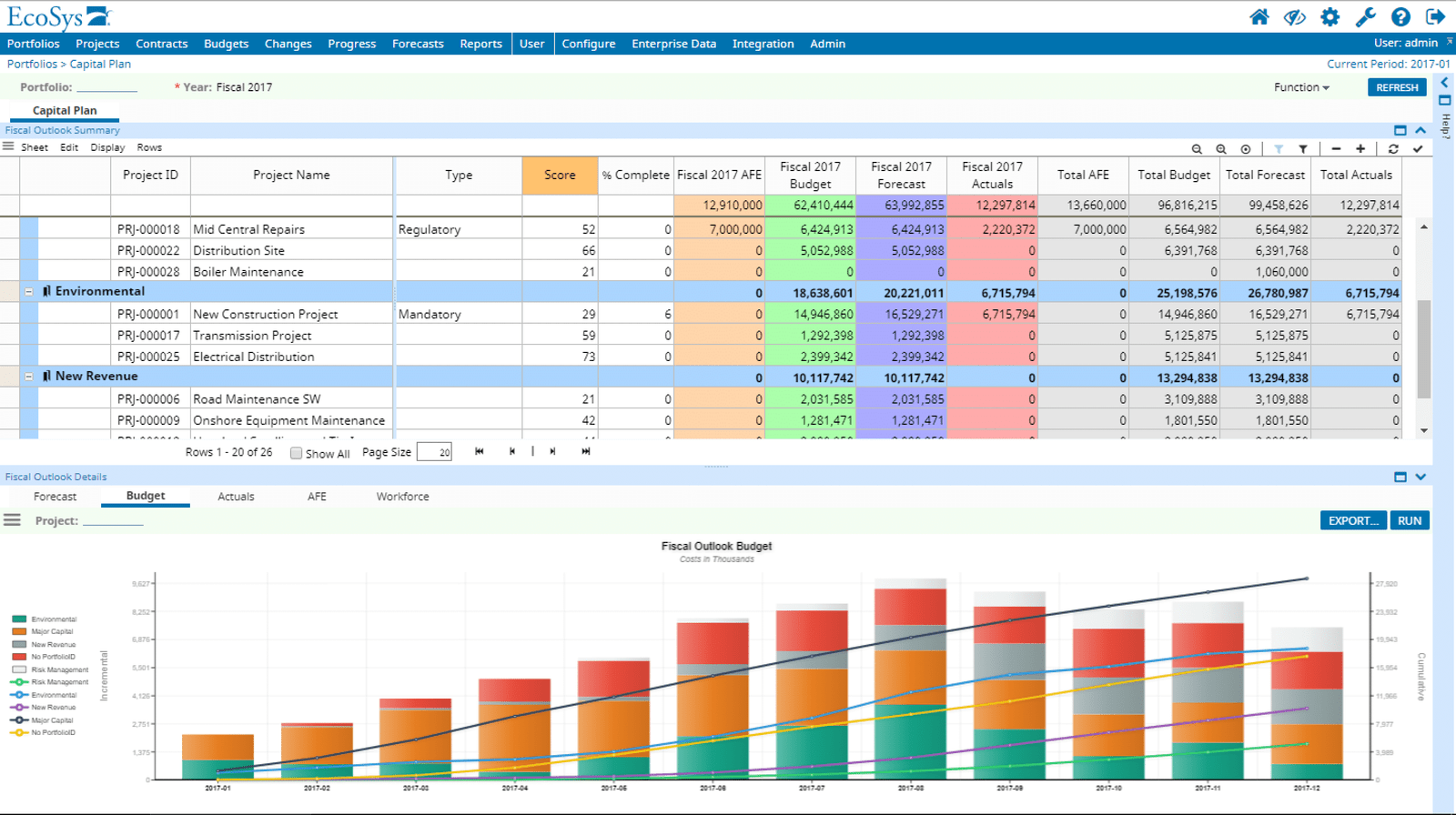

To begin tracking and monitoring your capital expenditures effectively, start by creating a comprehensive system for record-keeping. This can be as simple as setting up an Excel spreadsheet or using personal finance management software. Be diligent in recording all relevant details about each expenditure – date of purchase, item description, cost involved (including any associated fees), expected lifespan or depreciation rate if applicable.

Having this data at hand will help you evaluate the performance of each asset over time. For instance, if you bought a piece of equipment for your business five years ago but find that it has become obsolete or requires frequent repairs now, this information can guide future decisions regarding similar purchases.

Regularly reviewing and analyzing this data is the next step towards effective capital expenditure management. Set aside dedicated time every month or quarter to assess how each investment aligns with your goals and expectations. Look for patterns – do certain types of assets consistently yield higher returns? Are there specific areas where costs tend to escalate unexpectedly?

By identifying trends through analysis, you can adjust your spending strategy accordingly. Perhaps some assets require more attention in terms of maintenance or upgrades than initially anticipated; being proactive in managing them will save you money in the long run. On the other hand, if certain investments consistently underperform, it may be time to reconsider their value or explore alternative options.

Monitoring capital expenditures also provides valuable insights into your overall financial stability. By understanding how much of your wealth is tied up in assets that appreciate (or depreciate) over time, you can better gauge your net worth and make informed decisions about future investments. Additionally, tracking depreciation rates allows for more accurate reporting on tax returns and ensures compliance with relevant regulations.

Furthermore, monitoring capital expenditures helps prioritize savings goals and align them with your financial aspirations. For instance, if purchasing a new home is a priority for you, tracking and monitoring expenses related to this goal will provide a clearer picture of your progress towards achieving it. Adjusting spending patterns based on these goals will not only keep you focused but also help avoid unnecessary purchases that could hinder progress.

In conclusion, tracking and monitoring capital expenditures are essential components of effective personal finance management. It allows you to assess the performance of significant investments over time and make informed decisions about future purchases. By implementing a robust record-keeping system, regularly reviewing data trends, analyzing performance patterns, and adjusting strategies accordingly, you take control of your financial well-being while working towards achieving long-term goals. Remember: every dollar spent on an asset should bring value beyond its initial cost – so track wisely!