Tax-efficient Diversification Strategies

Investing is a great way to grow your wealth over time, but it’s important to do so in a tax-efficient manner. By implementing tax-efficient diversification strategies, you can maximize your returns and minimize the impact of taxes on your investments. In this article, we will explore some effective strategies to help you achieve this goal.

1. Asset Allocation: One key strategy is to allocate your investments across different asset classes such as stocks, bonds, and real estate. This not only helps spread risk but also provides opportunities for tax optimization. For instance, long-term capital gains from stocks are taxed at lower rates compared to short-term gains.

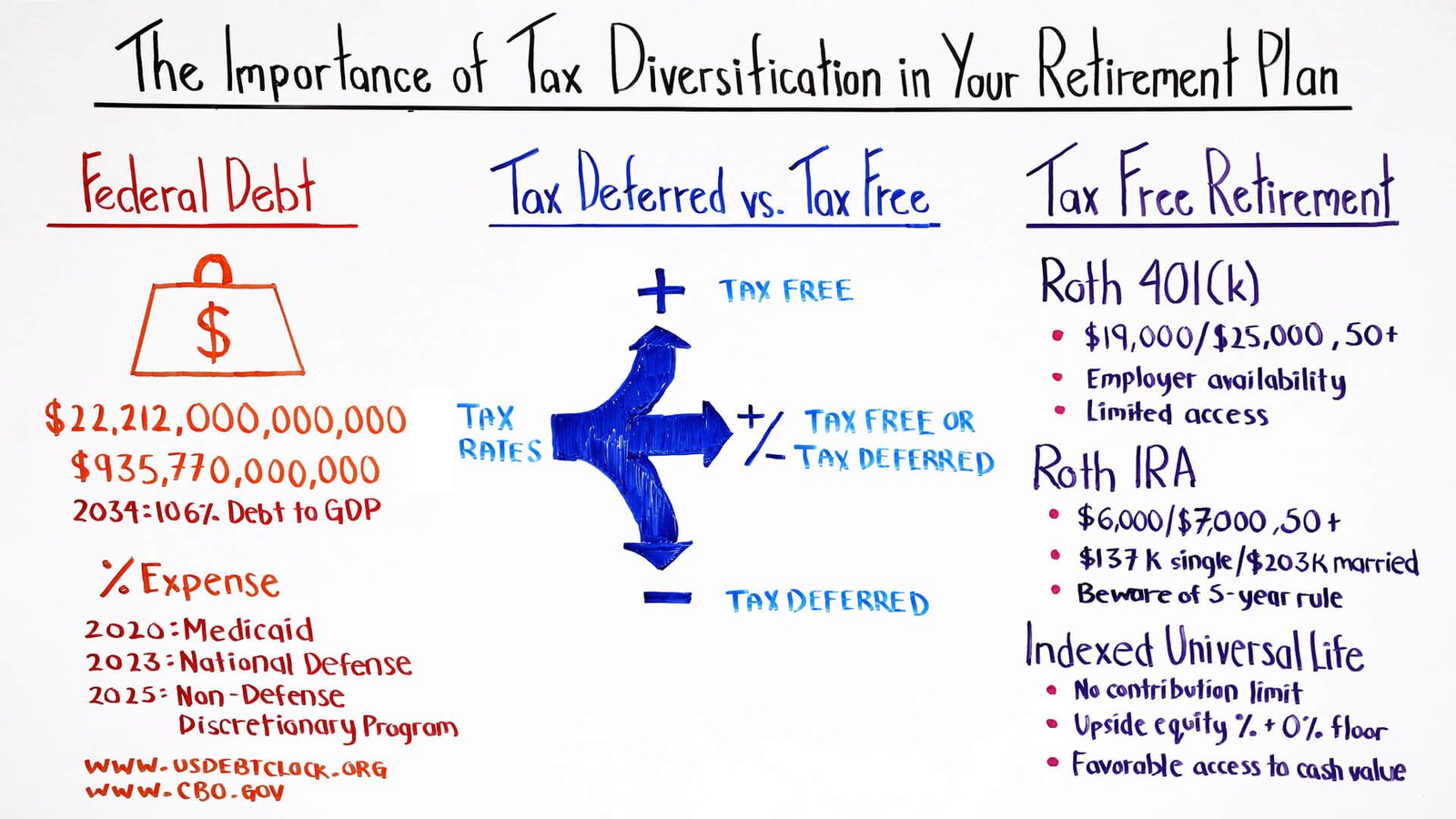

2. Tax-Advantaged Accounts: Take full advantage of tax-advantaged accounts like 401(k)s or individual retirement accounts (IRAs). Contributions made to these accounts may be tax-deductible (traditional) or grow tax-free (Roth). By utilizing such accounts, you can defer taxes on investment gains until withdrawal or even enjoy tax-free growth.

3. Tax-Loss Harvesting: Another useful strategy is tax-loss harvesting where you sell investments that have experienced losses in order to offset capital gains elsewhere in your portfolio. This helps reduce taxable income while staying invested in the market.

4. Dividend Reinvestment Plans (DRIPs): If you receive dividends from your investments, consider enrolling in DRIPs offered by many companies. With DRIPs, instead of receiving cash dividends, they are automatically reinvested into additional shares of the company’s stock without triggering immediate taxable events.

5. Municipal Bonds: Investing in municipal bonds can provide income that is exempt from federal taxes and sometimes state taxes too if issued within your state of residence. These bonds fund various public projects like infrastructure development and education systems.

6. Donor-Advised Funds (DAFs): If philanthropy is part of your financial goals, consider contributing to a Donor-Advised Fund. By donating appreciated assets like stocks, you can receive an immediate tax deduction and potentially avoid capital gains taxes on the appreciation.

7. Tax-Efficient Funds: Look for tax-efficient funds that strive to minimize taxable distributions by employing strategies like low turnover or investing in index-based ETFs (exchange-traded funds). These funds can help reduce your annual tax burden.

8. Estate Planning: Lastly, estate planning is crucial for efficient wealth transfer while minimizing potential estate taxes. Utilize tools such as trusts and gifting strategies to maximize the benefits of your investments for future generations.

It’s important to note that tax laws are subject to change, so it’s always wise to consult with a professional financial advisor or tax expert before implementing any specific strategy.

In conclusion, by incorporating these tax-efficient diversification strategies into your investment plan, you can optimize your returns while reducing the impact of taxes. Remember that everyone’s financial situation is unique, so it’s essential to tailor these strategies according to your goals and risk tolerance. With careful planning and adherence to sound investment principles, you’ll be well on your way towards achieving long-term financial success.