When it comes to saving money, finding the right bank and savings account is essential. With so many options available, it can be overwhelming to figure out which one is best for you. In this article, we will compare different banks’ savings account options and features to help you make an informed decision.

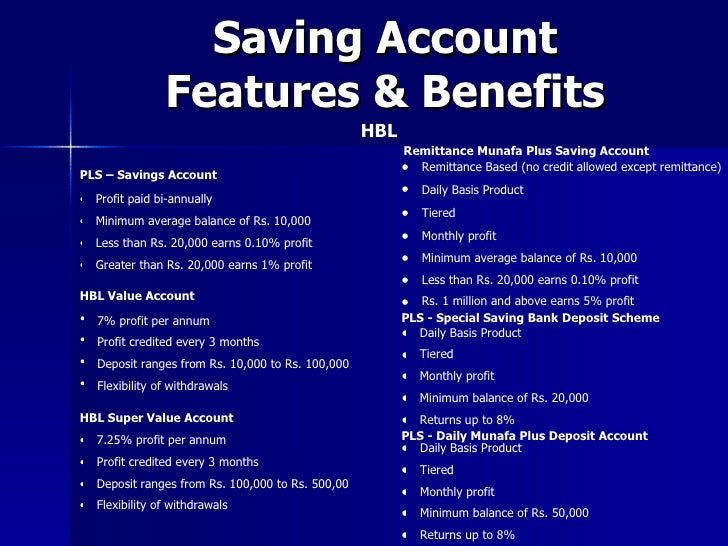

One important factor to consider when comparing savings accounts is the interest rate offered by each bank. The higher the interest rate, the more your money will grow over time. Some banks offer tiered interest rates where the rate increases as your balance grows.

Another feature to look for is the minimum balance requirement. Some banks require a certain minimum balance in order to open a savings account or avoid monthly fees. If you’re just starting out or don’t have a large amount of money to save, look for a bank that has no or low minimum balance requirements.

It’s also worth considering whether the bank offers online banking services and mobile apps. These tools can make managing your savings account much easier and convenient. Look for features like mobile check deposit, bill payment options, and real-time balance updates.

In addition to these basic features, some banks provide additional perks with their savings accounts. For example, some offer ATM fee reimbursements if you use an out-of-network ATM machine. Others may provide discounts on other financial products such as loans or credit cards.

Customer service is another important aspect to consider when choosing a bank for your savings account. Look for reviews or ask friends and family about their experiences with different banks’ customer service departments. Having access to friendly and helpful staff can make all the difference when dealing with any issues related to your savings account.

Lastly, don’t forget about safety and security measures offered by each bank. Look for FDIC insurance coverage which protects your deposits up to $250,000 per depositor per insured bank in case of bankruptcy or closure of the institution.

In conclusion, comparing different banks’ savings accounts is crucial to finding the best option for your financial goals. Consider factors such as interest rates, minimum balance requirements, online banking services, additional perks, customer service, and safety measures. By doing your research and comparing the different options available, you can make an informed decision that will help you grow your savings over time.