Non-Cumulative Preferred Stock: Understanding the Basics and Benefits

Welcome to another panel discussion on personal finance! In today’s post, we will be diving into the world of non-cumulative preferred stock. This type of investment is often overlooked but can provide investors with unique benefits and opportunities. Joining us today are three experts in the field: Jane, a financial advisor; Mark, an experienced investor; and Sarah, a seasoned portfolio manager. Let’s get started!

Jane: Thank you for having me here today. Non-cumulative preferred stock is a type of equity security that pays a fixed dividend to its shareholders before any dividends are paid to common stockholders. The key difference between cumulative and non-cumulative preferred stock lies in the payment of dividends.

Sarah: That’s correct, Jane. With cumulative preferred stock, if a company fails to pay dividends one year, those unpaid dividends accumulate and must be paid before any future dividend payments can be made. On the other hand, non-cumulative preferred stock does not have this feature – if a company misses paying out dividends in one year, they do not need to make up for it in subsequent years.

Mark: Exactly, Sarah. Non-cumulative preferred stocks offer greater flexibility for companies as they have no obligation to catch up on missed dividend payments. But this also means greater risk for investors as there is no guarantee of receiving missed or unpaid dividends.

Jane: Absolutely right, Mark! However, it’s important to note that non-cumulative preferred stocks typically have higher yields compared to their cumulative counterparts due to this increased risk factor.

Sarah: Yes, that’s true. Investors who are comfortable taking on more risk may find these higher yields appealing despite the lack of guarantee for missed or unpaid dividends.

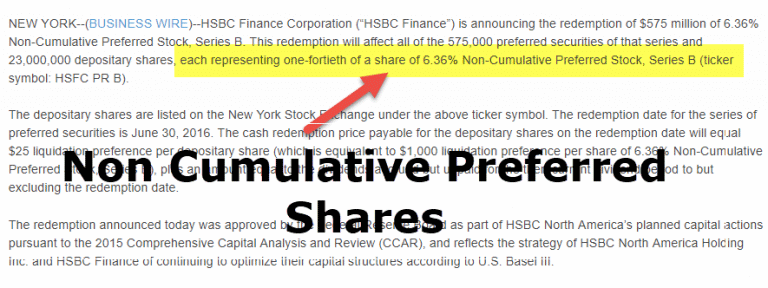

Mark: Additionally, non-cumulative preferred stocks often come with call provisions which allow issuers to redeem them at predetermined prices after a specific period. This can be advantageous for companies if interest rates decline, but it may result in investors losing out on potential future dividend income.

Jane: That’s an important point, Mark. Investors should consider the call provisions when evaluating non-cumulative preferred stocks to better understand the potential risks and rewards associated with them.

Sarah: I completely agree, Jane. It’s crucial to thoroughly research and analyze the terms and conditions of any non-cumulative preferred stock before making an investment decision.

Mark: Absolutely! And it’s also worth mentioning that non-cumulative preferred stockholders have a higher claim on company assets compared to common shareholders in the event of bankruptcy or liquidation.

Jane: Yes, that’s correct. Non-cumulative preferred stockholders are given priority over common shareholders when it comes to receiving dividends and distributing assets during liquidation.

Sarah: This preference in payment is a significant advantage for investors who prioritize stability and security in their portfolio. It provides a layer of protection against potential losses as they rank above common equity holders.

Mark: Agreed! Non-cumulative preferred stocks can be an attractive option for income-focused investors looking for stable dividend payments while still having some exposure to equities.

Jane: Definitely! They offer a middle ground between bonds and common stocks – providing consistent income like bonds but with potentially higher yields than traditional fixed-income securities due to their equity-like characteristics.

Sarah: In summary, non-cumulative preferred stocks can be an interesting addition to an investor’s portfolio. They provide opportunities for higher yields compared to cumulative preferred stocks but come with increased risk due to missed or unpaid dividends not being made up in subsequent years. Additionally, they offer more stability than common shares during bankruptcy or liquidation events, making them appealing options for income-oriented investors seeking a balance between fixed-income securities and equities.

Mark: Well said, Sarah! As always, conducting thorough research and consulting with your financial advisor is crucial before making any investment decisions.

Jane: I couldn’t agree more, Mark. It’s important to understand the risks and rewards associated with non-cumulative preferred stocks to make informed choices that align with your financial goals and risk tolerance.

That concludes our panel discussion on non-cumulative preferred stock. We hope you found this conversation enlightening and valuable for your investment journey. Thank you for joining us today, and we’ll see you again soon for another engaging personal finance topic!