Dividends: The Powerhouse of Passive Income

When it comes to building wealth and achieving financial freedom, one of the most effective strategies is investing in dividend-paying stocks. Dividends are a portion of a company’s profits that are distributed to its shareholders, typically on a quarterly basis. They can be an excellent source of passive income and provide investors with significant long-term benefits.

The allure of dividends lies in their ability to generate cash flow without requiring active involvement from investors. Unlike other forms of income, such as wages or rental properties, dividends do not demand your time or effort once you have invested in the right stocks. This makes them an ideal vehicle for those seeking to increase their income streams while maintaining flexibility and independence.

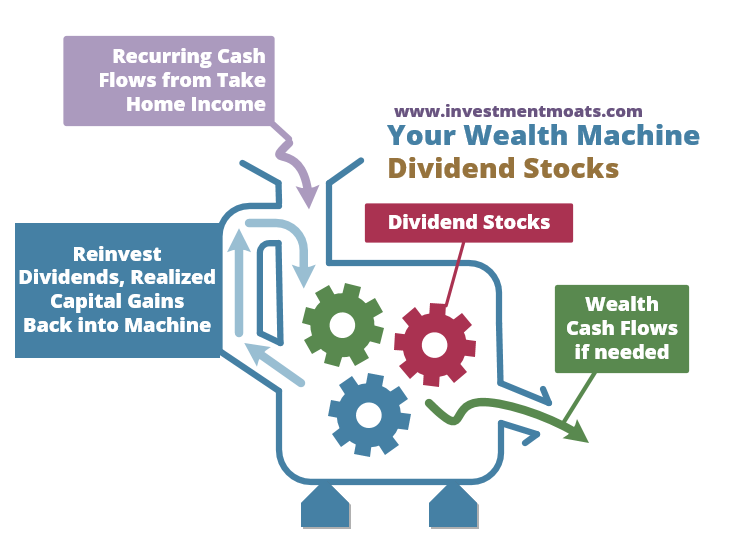

One major advantage of dividends is their potential for compounding growth over time. By reinvesting your dividend payments back into additional shares of stock, you can accelerate the growth of your investment portfolio exponentially. This process is known as dividend reinvestment, and it allows you to harness the power of compounding interest by buying more shares at regular intervals.

Let’s take a closer look at how this works through an example:

Suppose you invest $10,000 in Company X, which has a dividend yield (the annual dividend payment divided by the stock price) of 4%. In year one, you would receive $400 in dividends ($10,000 * 0.04). If you choose to reinvest these dividends back into Company X’s stock at its current price rather than taking them as cash, you will purchase an additional $400 worth of shares.

Assuming that Company X maintains its 4% dividend yield and doesn’t experience any changes in share price or payout rate over time (which is unrealistic but useful for illustrative purposes), let’s see what happens after ten years:

Year Dividend Reinvestment

1 $400 $400

2 $416 $416

3 $432 $432

4 $448 $448

5 $464 $464

6 $480 $480

7 $496 $496

8 $512 $512

9 $528 $528

10 $

This table demonstrates the power of compounding. Over ten years, your initial investment of justt will have grown to nearly . Not only that, but your annual dividend payments will have increased from to over the same period.

It’s important to note that while this example assumes no changes in share price or dividend yield, in reality, companies can and do increase their dividends over time. This means that your passive income stream has the potential to grow even further as companies raise their payouts.

Another advantage of dividend investing is its ability to provide a consistent income stream regardless of market conditions. While stock prices may fluctuate wildly due to economic downturns or other external factors, companies with a history of paying dividends tend to be more stable and resilient during tough times.

Dividends act as a cushion against market volatility by providing a regular source of income independent of capital gains. Even if the value of your stocks temporarily declines due to market fluctuations, you can still rely on your dividends for ongoing cash flow. This stability makes dividend-paying stocks an attractive option for retirees who depend on their investments for living expenses.

Furthermore, dividend investing offers certain tax advantages compared to other forms of income generation. In many countries, including the United States, qualified dividends are subject to lower tax rates than ordinary income or capital gains. This favorable tax treatment allows investors to keep more money in their pockets and boost overall returns.

However, it’s important not just to chase high-dividend yields blindly without considering other factors such as company fundamentals and sustainability. A high-yielding stock may indicate financial distress or an impending cut in dividends rather than a great investment opportunity. It’s crucial to conduct thorough research and consider a company’s track record, financial health, and future prospects before investing.

In conclusion, dividends are a powerful tool for building wealth and achieving financial independence. Their ability to generate passive income, compound growth over time, provide stability during market volatility, and offer tax advantages make them an attractive option for investors of all ages.

By strategically selecting dividend-paying stocks and reinvesting the cash flow generated from these investments back into additional shares, you can supercharge your portfolio’s growth potential. So start exploring the world of dividends today and unlock the doors to a brighter financial future.