Savings Account Interest Rates: What You Need to Know

In today’s uncertain financial landscape, it is more important than ever to find ways to make your money work for you. One of the most popular and accessible options for individuals looking to grow their savings is a traditional savings account. However, with so many different banks and financial institutions offering varying interest rates, it can be difficult to determine which option is best for you.

In this article, we will explore the ins and outs of savings account interest rates – what they are, how they work, and what factors influence them. By understanding these key concepts, you will be better equipped to make informed decisions about where to stash your hard-earned cash.

What are Savings Account Interest Rates?

Simply put, a savings account interest rate refers to the percentage of interest that a bank pays on funds deposited into an individual’s savings account over time. This means that as you save money in your account, the bank will pay you interest based on the agreed-upon rate. The higher the interest rate, the more growth potential your money has.

How Do Savings Account Interest Rates Work?

Most savings accounts accrue compound interest – meaning that not only does your initial deposit earn interest but also any additional contributions or earned interest thereafter. Compound interest allows your money to grow exponentially over time.

For example, let’s say you have $10,000 in a savings account with an annual percentage yield (APY) of 2%. After one year, assuming no withdrawals or additional deposits were made during that period and no changes occurred in the APY offered by the bank; your balance would increase by $200 ($10,000 x 0.02). In subsequent years, this process continues with each year’s accrued interest being added onto both your initial deposit and previously earned interests.

Factors Influencing Savings Account Interest Rates

Several factors can influence savings account interest rates:

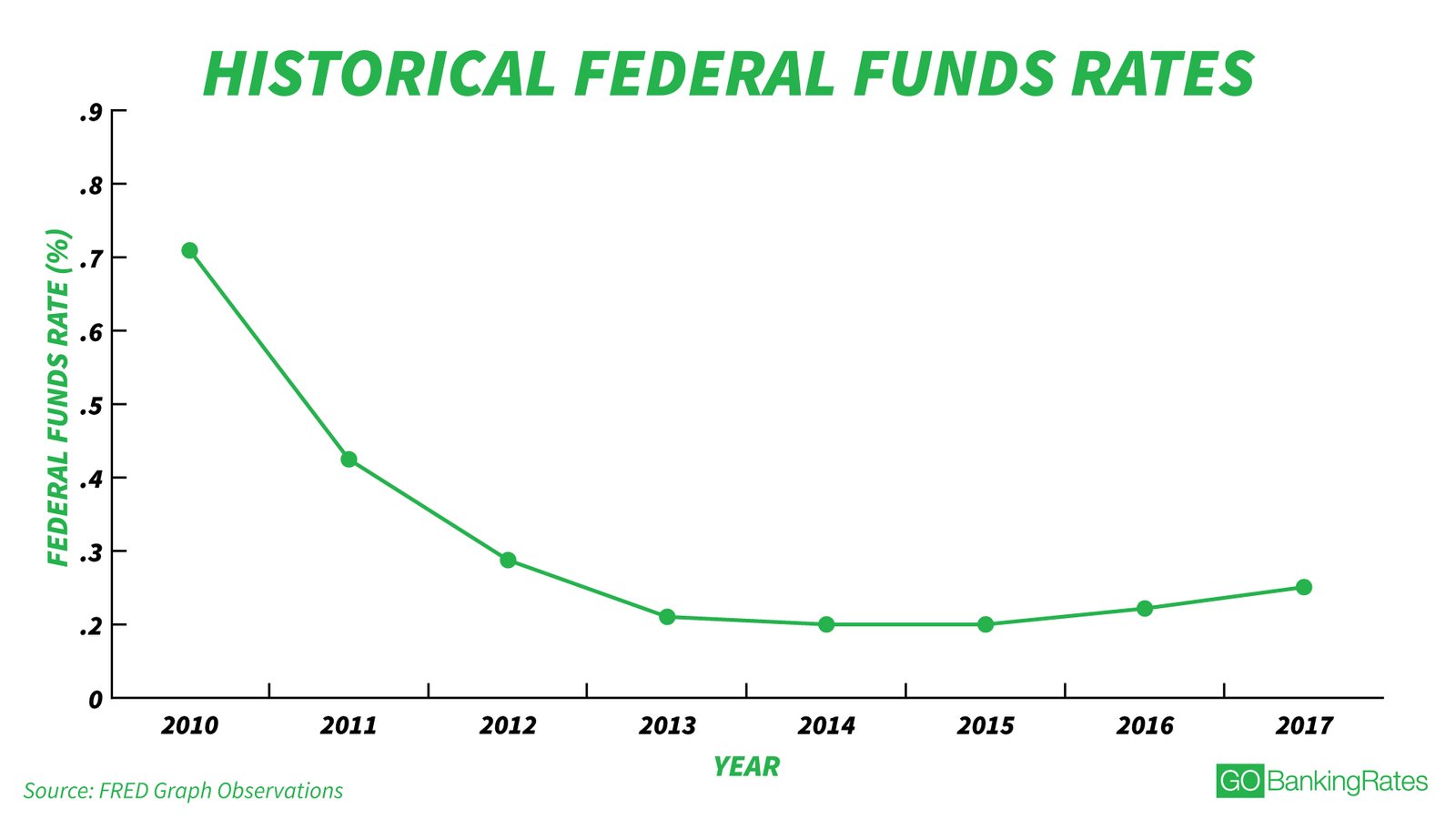

1. Federal Reserve Policy: The Federal Reserve plays a significant role in determining interest rates across the economy. When the Federal Reserve lowers or raises benchmark interest rates, it can impact savings account rates as well.

2. Market Conditions: Interest rates are also influenced by overall market conditions and economic indicators. In times of economic prosperity and stability, banks may offer higher interest rates to attract more deposits. Conversely, during periods of economic downturn, banks might lower their interest rates due to reduced lending capacity.

3. Bank Policies: Different financial institutions have different policies when it comes to setting savings account interest rates. Some banks may prioritize attracting new customers with competitive initial rates but then gradually decrease those rates over time or impose certain conditions for maintaining higher yields.

4. Account Balance: In some cases, the amount of money you have deposited in your savings account can affect the interest rate you receive. Banks often provide tiered structures that offer higher interest rates for larger balances.

5. Type of Savings Account: Different types of savings accounts may come with varying interest rate options depending on their purpose and features. For example, high-yield savings accounts typically offer more competitive APYs than regular savings accounts because they require higher minimum balances or restrict access to funds.

Tips for Maximizing Your Savings Account Interest

Now that we understand how savings account interest works let’s discuss a few tips on how you can maximize your earnings:

1. Compare Rates: Before opening a new savings account or sticking with your current one, compare offerings from various banks to find the best available rate for your needs.

2. Consider Online Banks: Online-only banks typically have lower overhead costs compared to traditional brick-and-mortar institutions, allowing them to offer more attractive interest rates on their products.

3. Look out for Promotions and Bonuses: Banks often run promotions where they provide sign-up bonuses or introductory offers with higher-than-average APYs for an initial period of time – taking advantage of these can give your savings a head start.

4. Automate Your Savings: Set up automatic transfers from your paycheck or checking account to your savings account. This way, you won’t forget to save and will consistently contribute, maximizing the compounding effect of interest over time.

5. Avoid Monthly Fees: Some banks charge monthly fees for their savings accounts, which can eat into the interest earned. Look for fee-free options or find out if there are ways to waive those fees through specific requirements such as maintaining a minimum balance or linking with other accounts or services offered by the bank.

In conclusion, understanding how savings account interest rates work and what factors influence them is essential for making informed decisions about where to keep your hard-earned money. By comparing rates, considering online banks, looking out for promotions and bonuses, automating your savings contributions, and avoiding unnecessary fees, you can maximize the growth potential of your savings account. Remember that while interest rates are important when choosing a bank or financial institution; it’s also crucial to consider other factors like customer service quality and convenience in managing your finances effectively.