Reporting capital losses on tax returns is an important aspect of managing personal finances. Capital losses occur when the sale of an investment results in a decrease in value compared to its purchase price. While no one wants to experience financial losses, it’s essential to understand that reporting these losses can have potential benefits when it comes to tax season.

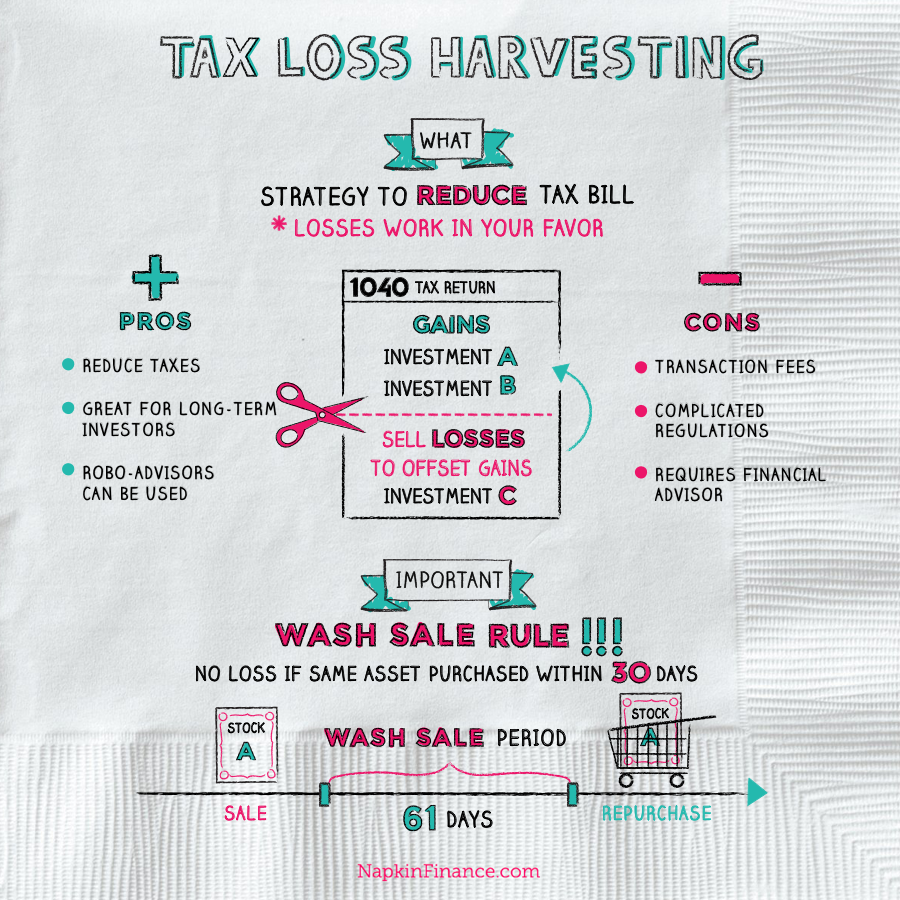

When filing taxes, individuals can offset their capital gains by deducting their capital losses from their taxable income. This process is known as tax loss harvesting and can help mitigate the overall tax liability. If your total capital losses exceed your capital gains for the year, you can even use those excess losses to offset other income, such as wages or salary.

To report your capital losses accurately, you must complete Schedule D (Form 1040) along with your federal tax return. Make sure to provide all necessary information about each investment sold during the year, including purchase and sale dates, cost basis, proceeds from sales, and any adjustments or expenses related to the transactions.

It’s essential to note that there are limitations on how much you can deduct in a given year for capital losses. For individuals filing jointly or single taxpayers, the maximum deductible amount is $3,000 ($1,500 if married filing separately). However, if your net loss exceeds this limit in a particular year, you can carry over unused amounts into future years.

In conclusion, properly reporting capital losses on your tax returns is crucial for maximizing potential deductions and minimizing overall tax liability. It’s advisable to consult with a qualified accountant or tax professional who can guide you through this process and ensure compliance with relevant regulations.